Arizona’s economic researchers say 2014 looks flat and steady. At least, say the optimists among them, we’re not going backward. The problem is jobs. One of every five Arizona workers has a job in two industry categories, either “retail” or “professional and business services.”

Arizona’s economic researchers say 2014 looks flat and steady. At least, say the optimists among them, we’re not going backward. The problem is jobs. One of every five Arizona workers has a job in two industry categories, either “retail” or “professional and business services.”

Arizona’s 2013 job growth in these critical categories lagged behind national growth. Arizona will add jobs in 2014, but at half the rate it needs to catch up to a typical year, says Lee McPheters, research economist at Arizona State University’s W. P. Carey School of Business.

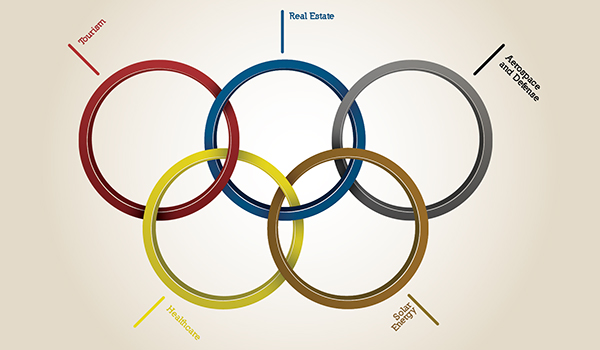

“In other words, this huge part of the Arizona economy is expanding below the national average, even though construction is growing faster than nationally, even though finance is growing faster than nationally,” McPheters says. He notes that, without federal money and facing a weak national economy, states are on their own to stimulate their economies. Yet, in Arizona’s case, many of the traditional growth sectors, such as tourism and real estate, are tied to a weak national economy, and the deep cuts to the federal budget known as sequestration are limiting the number and amount of government contracts and, therefore, limiting growth of high-paying jobs in industries such as bioscience and aerospace and defense research and development.

Tourism Is Still on the Move

Arizona’s sun still draws returning snowbirds and other winter visitors who bring new dollars to pump up the economy, says Cheryl Cothran, hospitality industry researcher at Northern Arizona University’s W. A. Franke College of Business. The sun, however, is not enough to attract business travelers. After a decline during the recession, businesspeople are on the move again, but they are taking shorter flights to places like Chicago and Denver and cheaper flights to Las Vegas, and this hurts jobs at Arizona’s large resorts and hotels that count on large conferences and conventions to fill their rooms.

The recession had a bright side for the state’s rural towns, however. More regional tourists traveled by car to save money. These tourists were drawn to local niche attractions, such as the growing wine industry in Verde Valley and southeastern Arizona. Places like Cottonwood have resurrected their downtowns with tasting rooms, craft beers, locally grown foods and a distinctive history, says NAU hospitality researcher Thomas Combrink.

Despite the recession, foreign travelers never stopped visiting Grand Canyon National Park. The state has fallen out of the top 10 for international travel, however, now coming in at number 12. “If it wasn’t for the Grand Canyon, we wouldn’t be in that list at all,” Cothran says. “Places like Florida are really booming with internationals from places like Latin America. California and New York capture loads on internationals. And then Vegas.”

Some market watchers say Arizona’s rough handling of illegal immigrants has not helped its ability to attract international travelers. Glenn Hamer, CEO and president of the Arizona Chamber of Commerce and Industry, who has been on trade missions with state leaders, says relations with Mexico are warming just as the state is warming up to immigration reform. He believes new flight routes recently opened between Mexico and Phoenix Sky Harbor International Airport will help. “Our tourism relationship with our North American friends is moving in the right direction. We should start seeing that in some of the numbers.”

Real Estate Is on a Slow Climb

In the residential real estate market, the first half of 2013 had homebuyers outnumbering sellers. The median price of a Phoenix-area single-family home rose 32.7 percent between September 2012 and September 2013, according to Michael Orr, real estate researcher at the W. P. Carey School of Business. But the government shutdown in October unnerved some potential buyers, and, while home values continued to rise, the cooling market slowed job growth and weakened incomes in the sector. Orr expects the market will pick up volume in 2014, but not enough for the sector to gain jobs.

The commercial market, static the last half of 2012 because of the uncertainty of an election year and the bickering in Washington, D. C. over spending cuts and taxes, had been expected to prove robust for 2013, according to Craig Henig, CBRE’s senior managing director. “That has not been the case, and now I think that confidence is at an all-time low, and the [federal government] shut-down didn’t help recently,” Henig says. “We don’t have very good job growth and that’s what needs to happen here.”

As commercial space rebounds, it is expected to take a different shape. Online shopping will change what retailers put on their shelves, Henig says. For example, retailers may dedicate more space to shoes because consumers still want to try them on. Large electronic retail stores already limit space dedicate to CDs or DVDs, because consumers can download them from their computers. Similar to retail space, companies will reshape the rebound in office space. The trend is toward what Henig calls “bullpen offices” with one large open space shared by all employees and a few large conference rooms. More employees already work from home, which, he points out, leads to companies needing less space.

“We’re one of the better states in seeing the housing values increase over the past year,” Hamer says. But, noting that of the more than 300,000 jobs Arizona lost during the Great Recession, half were in the construction of new homes and commercial real estate, he sees it being a long, slow climb to the “go-go years” of the early and mid-2000s.

Healthcare Outperforms Bioscience

To Barry Broome, CEO and president of the Greater Phoenix Economic Council, the bioscience part of the economic equation is insignificant. He believes the state is not a player in drug development and biotechnology because Arizona has not invested in the University of Arizona’s medical school. Noting that 66 percent of California’s biotechnology industry spins out of California’s medical schools, he says, “So if you have a medical school that is unfunded, if you have a medical school that isn’t supported, if you have a medical school that is too small, you’re not going to end up with any kind of bioscience program.”

Although bioscience was a growing sector over the last decade, investments in Arizona’s industry are drying up. That lack of cash is flattening the state’s trajectory and weakening its reputation as the next bioscience hub, says Walter Plosila, senior advisor for Battelle Technology Partnership Practice and author of the annual Arizona’s Bioscience Roadmap. “We’ve been trying to raise the concern for years,” he says. “It takes perseverance, continuity and sticking to it.”

Bioscience production does not work like an information technology start-up, which can take a new product to market within six months, Plosila explains. Bioscience means the creation and distribution of pharmaceuticals, surgical and diagnostic tools and medical implants — a process that takes a coordinated effort. For example, state university researchers must collaborate with researchers in private nonprofit organizations, such as the Translational Genomics Research Institute. Hospitals must be willing to help create and test new products. A network of smaller businesses then must join the team to manufacture and distribute products. This ongoing cooperation is needed to move a discovery into an application and then through its trials and regulatory approval, and Plosila notes the process takes 10 to 20 years and willing investors.

Investors typically join syndicates to invest in several bioscience projects, dividing the rewards and risks among members. In the last few years, however, there hasn’t been enough local capital in Arizona to entice investors from other states to create investment syndicates, according to Plosila. Federal stimulus grants that helped the industry weather the recession are gone, and, while grant money from the National Institutes of Health is still flowing, there is less money and more competition. Plosila observes that Arizona offers one of the most generous research and development tax credits in the country, but it isn’t enough. Efforts to entice the state to kick-start a pool of private and public bioscience investment funds have failed. “This is one serious gap in Arizona that really hampers it,” Plosila says. “You can have the best research in the world, but if you don’t have the capital to take the product to market, what can you do but end up exporting your research to somewhere else that will get it to market?”

Arizona is, however, a big player in healthcare. The state is home to an unusually high number of top-tier healthcare centers, such as Phoenix Children’s Hospital and the Mayo Clinic, each with a global reputation and a record of growth. Pointing out that 2,000 people work in bioscience while 250,000 work in healthcare, Broome says, “Healthcare excellence is where we’re getting our lift.”

The state recently expanded federal Medicaid eligibility to about 350,000 state residents as part of the federal health insurance reform. Hospitals will no longer be burdened with the cost of caring for these uninsured, low-income residents. The change allows the sector to continue to grow and produce jobs; Broome believes it gives Arizona an edge over competitors, such as Texas and Florida — states that did not expand healthcare coverage for low-income residents.

Aerospace and Defense Are on the Line

The deep, annual, across-the-board cuts in federal spending mandated by Congress, known as sequestration, are threatening the entire aerospace and defense industry. Arizona ranks among the top five states for its aerospace and defense industry, and Arizona’s sector grew faster than any other state’s during the 1990s. If federal cuts continue and impact research and development, then large Arizona corporations, such as Honeywell, could shut down plants, and smaller supply-chain businesses that rely on them will contract and many will close. Wonders Broome, will the state remains a top state for the aerospace and defense industry and will the sector still produce enough jobs to be worth much in the future? “So the policy question will be, ‘Is defense going to be an industry that really matters in the U.S. in 10 years?’” Broome says.

If sequestration does spare the Arizona industries, Broome believes the state still needs to bolster its universities’ engineering programs and find pubic funds to sponsor research projects that create new technology, such as the civilian use of drones.

Arizona has weather and varied terrain that make it ideal for testing drones in development. According to Hamer, our state already has had more test flights than any other state. Some states restrict where drones can fly, making it more difficult for testing. “Our legal framework and regulatory framework in Arizona is very positive,” Hamer says. “So this is an area I would expect that we could see a lot of new jobs.”

Federal money still is flowing for the development of drones, now referred to by the friendlier names of “unmanned aerial systems” (UAS) or “unmanned aerial vehicles” (UAV), says retired Brigadier Gen. Thomas Browning, USAF. The future of unmanned vehicles is not military but civilian use, such as surveying farm fields or determining the hot spots and geography of wildfires. Japan is already using drones to spray crops. “You are only limited by your imagination about what these things can do,” Browning says.

Browning, co-author of Arizona Aerospace Defense and Security Enterprise Strategic Plan 2011-2013, believes Arizona is particularly well suited for research and development of unmanned aerial systems. Just how fast Arizona develops this sector is dependent on a seven-volume proposal made to the Federal Aviation Administration to become one of six unmanned aerial system industry hubs in the country. That would shake the sector out of its complacency and grow new research, new companies and new jobs.

Arizona is one of 25 sites in the running and the FAA’s decision is due after this issue goes to press, Dec. 31. If Arizona is not selected as a site, Browning says, it will need to raise its capacity and its profile as a national and global player in the industry.

Solar Energy Is Still Warming Up

Arizona’s potential as a solar industry hot spot has waxed and waned along with the still bumpy evolution of solar technology and manufacturing. Some call our relentlessly sunny days the state’s edge in building a solar industry. Others say sun guarantees only that Arizona is a good place to use solar energy, not to build a manufacturing and distribution sector that provides significant jobs.

Arizona’s current potential in solar depends on the development of two technologies: concentrated solar and photovoltaic. Concentrated solar technologies use huge fields of solar mirrors that focus energy onto towers, which then generate steam to turn turbines and create electricity. There are several concentrated solar plants in Arizona and the southwest region, and our state is home to several component manufacturers as well.

“That’s where Arizona looked extremely attractive because of the volume of sun,” says Robert Mittelstaedt, dean emeritus of the W. P. Carey School of Business. “They thought it was going to be the future. Now, it turns out photovoltaic electricity is eclipsing concentrated solar in terms of cost.”

Solar photovoltaic technologies use material placed on a building’s roof that converts light energy into electricity. Solar photovoltaic was never cost-effective until the industry recently found cheaper ways to manufacture the rooftop panels, explains Mittelstaedt, now senior fellow at ASU’s Utility of the Future Center. Governments, particularly in Europe and the United States, were eager to reduce man-made emissions that impact global climate change. Governments began to subsidize, or require utility companies to subsidize, households and businesses that installed panels and produced their own photovoltaic electricity. The problem is, rooftop electricity also needs a traditional power grid with capacity to step in and seamlessly provide power when sun power wanes. In the short run, there is no cost-effective way to meld the two systems, observes Mittelstaedt; keeping capacity idling online when the sun-generated electricity can’t handle the load is very expensive.

Tempe is headquarters for First Solar, a leading provider of photovoltaic solar energy systems in the world. The company, along with state universities and other private companies, is working on research and development in the solar industry. However, for photovoltaic solar power to become an Arizona growth industry, it must create a significant number of jobs from local manufacturing plants and distribution centers. Arizona jobs in the industry now are mainly confined to rooftop solar installation.

“I think it’s a fable to talk about this being the center of the world for the solar industry, because the use of the product and where it is produced are completely unrelated here,” Mittelstaedt says.

Broome, whose organization has spent a great deal of time attracting solar companies to Arizona, says it is too early to write off the solar industry as a growth sector for the state. He sees concentrated solar as a viable and growing technology and the only current technology that can produce enough energy to reduce the area’s carbon footprint. Concentrated solar is already producing manufacturing jobs in Arizona, as opposed to photovoltaic, which currently is dependent on the finite and fickle construction industry.

Broome expects Arizona to produce somewhere between 25,000 and 40,000 jobs in the solar energy industry within the next decade. That is a small percentage of the 350,000 jobs the Phoenix area will need, he says, but the solar sector along with other renewable energies will be a contributor. “It’s overwhelmingly going to have a future here,” says Broome about solar. “The question is, how big of a future, what is it going to look like and what is its value?”

With states on their own to stimulate their economy, governors — including Arizona’s — are taking international trips to entice global trade and investment and are attempting to lure businesses away from other states to create jobs in their own. Unemployment is expected to come down very slowly in 2014, with cautious consumers, busy paying off their debts, seeing home values and the stock market go up. Arizona depends on the same elements that drive the national economy — such as consumer spending, business expansion, tourism and construction — and the good news is, people are once again moving into the state.