CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released its latest Single-Family Rent Index (SFRI), which analyzes single-family rent price changes nationally and across major metropolitan areas.

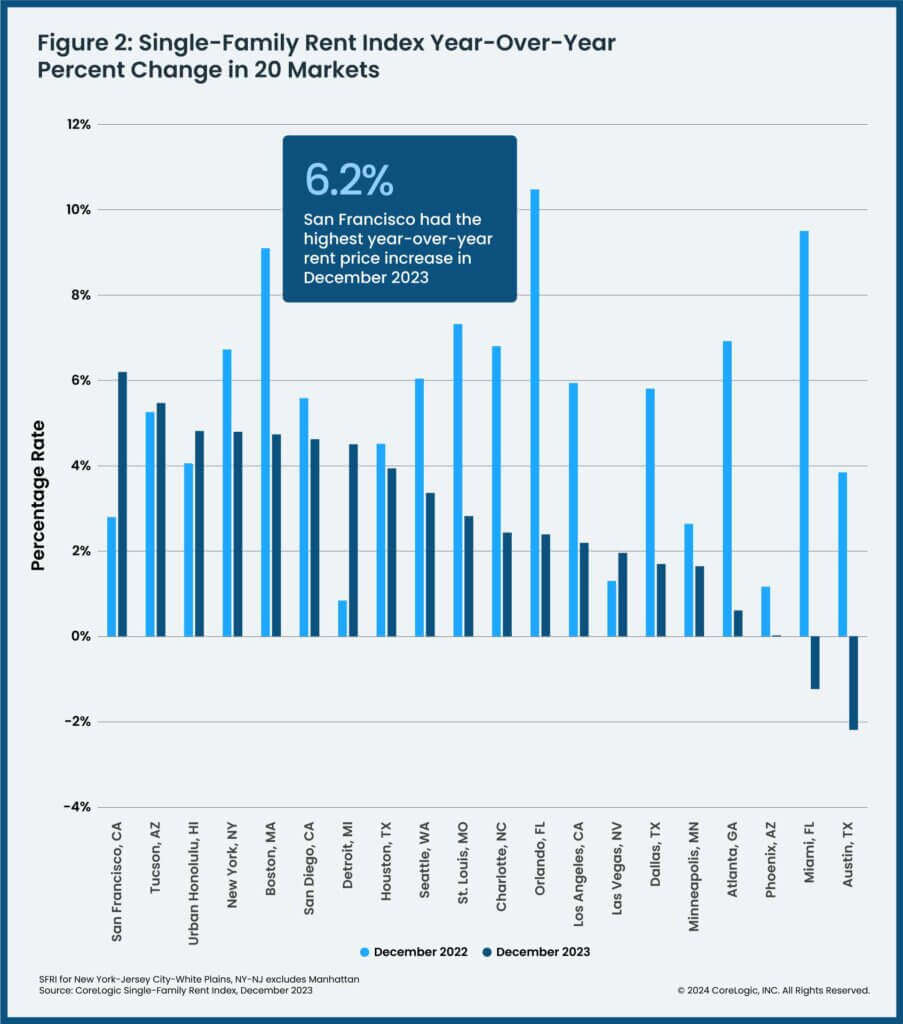

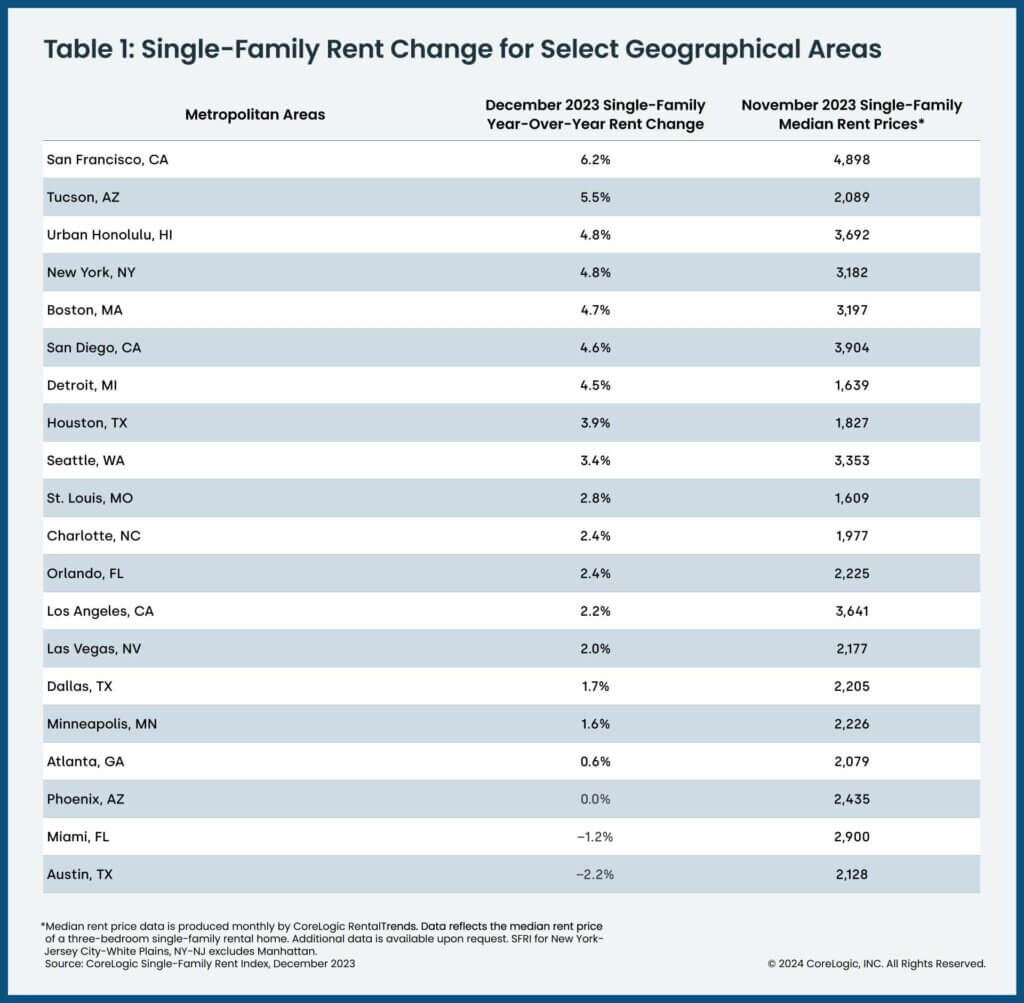

Annual single-family rent growth remained in line with pre-pandemic trends in December. San Francisco posted the largest year-over-year gain at 6.2%. Despite that metro area’s recent high-profile tech company layoffs and steep rental costs (a median of about $4,900 per month in November), growth trends continue to indicate that at least some renters are slowly migrating back to more expensive coastal metro areas. Tucson, Arizona was the only metro in the top five for annual rent growth where the median cost was less than $3,000 per month.

“Single-family rent growth closed out 2023 in positive territory, up by 2.8% annually in December,” said Molly Boesel, principal economist for CoreLogic. “Strong rent growth in the summer propelled the annual gain, while monthly increases in the fourth quarter showed rents falling slightly more than is typical for the season. Single-family rent growth should remain in the range of about 2% to 4% for 2024.”

CoreLogic Chief Economist Dr. Selma Hepp added: “The recent reacceleration of the Consumer Price Index’s Owners’ Equivalent Rent of Residences (OER) index caused some concern, but since those numbers reflect single-family rents with a nine-to-12-month lag, the most recent CoreLogic SFRI data suggests that the OER will revert to a slower growth rate and return to the pre-pandemic average over the next year.”

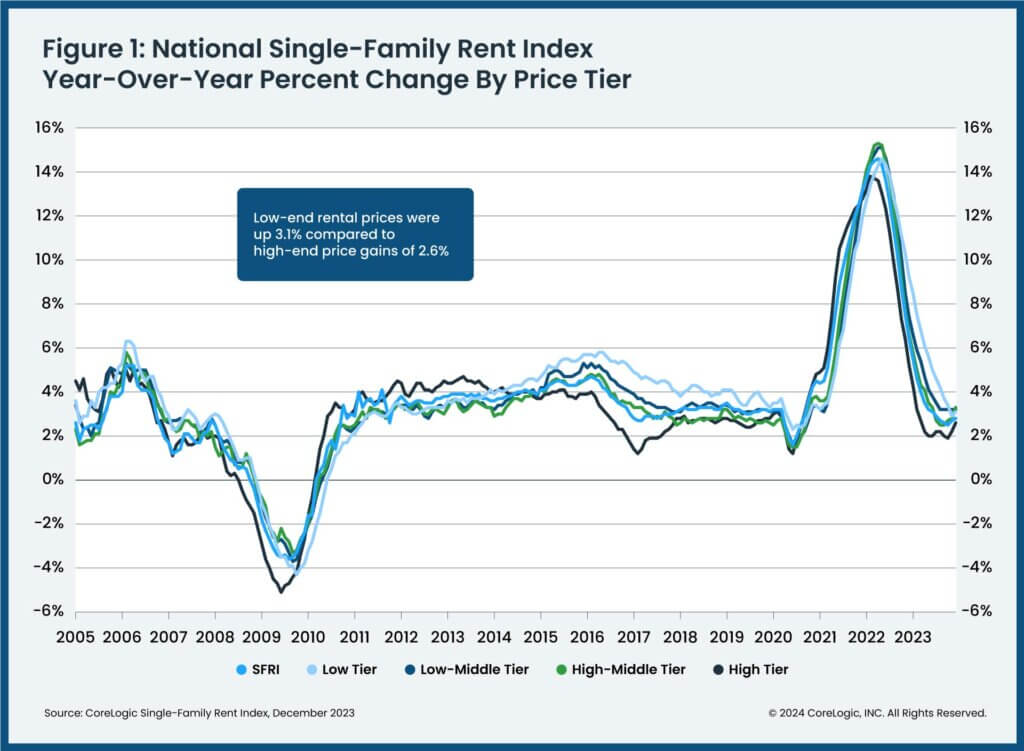

To gain a detailed view of single-family rental prices across different market segments, CoreLogic examines four tiers of rental prices and two property-type tiers. National single-family rent growth across those tiers, and the year-over-year changes, were as follows:

- Lower-priced (75% or less than the regional median): up 3.1%, down from 9.2% in December 2022

- Lower-middle priced (75% to 100% of the regional median): up 3.2%, down from 7.4% in December 2022

- Higher-middle priced (100% to 125% of the regional median): up 3.3%, down from 6.6% inDecember 2022

- Higher-priced (125% or more than the regional median): up 2.6%, down from 5.2% in December 2022

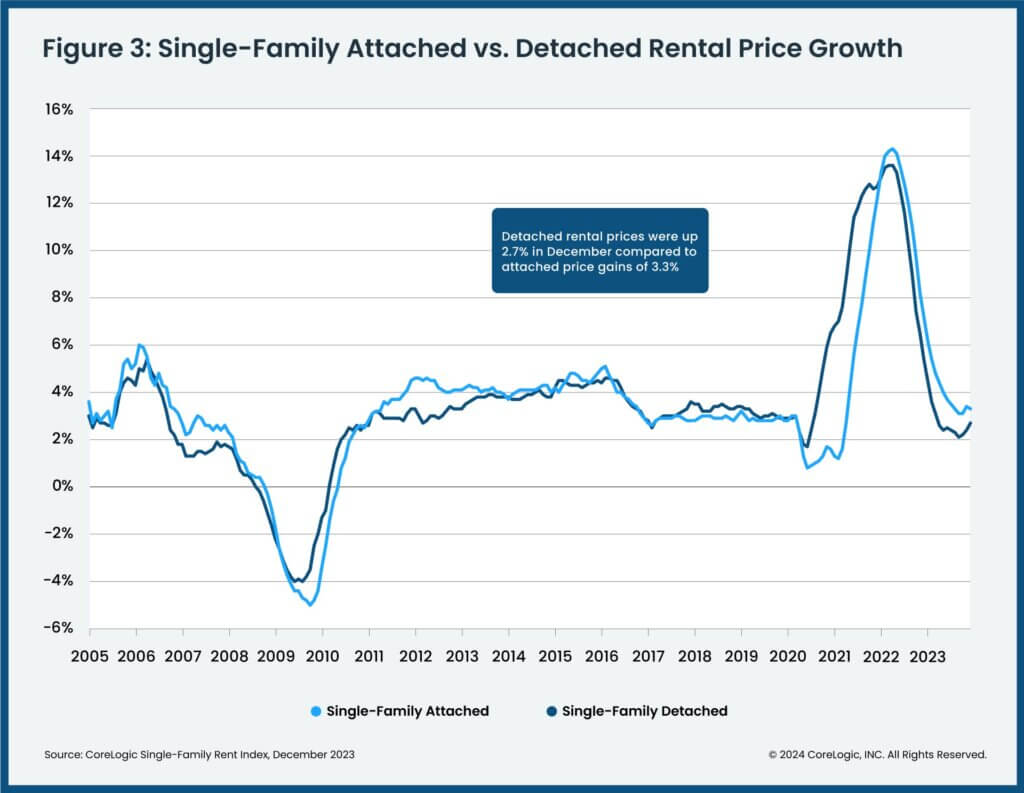

- Attached versus detached:Attached single-family rental prices grew by 3.3% year over year in December, compared with the 2.7% increase for detached rentals.

Of the 20 metros shown in Table 1, San Francisco posted the highest year-over-year increase in single-family rents in December 2023, at 6.2%. Tucson, Arizona registered the second-highest annual gain at 5.5%, followed by Honolulu and New York, both at 4.8%. Austin, Texas (-2.2%) and Miami (-1.2%) again posted annual losses.

No related posts.