CoreLogic, a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for August 2023.

CoreLogic’s Home Price Index dropped to an 11-year low in the spring of 2023 but is starting to regain momentum. While some states in the West still posted annual home price losses in August, that number has been decreasing since the spring of this year. Meanwhile, housing markets in New England are starting to heat up, with New Hampshire, Maine, Vermont and Rhode Island seeing the largest year-over-year price gains in August.

“While continued mortgage rate increases challenge affordability across U.S. housing markets, home price growth is in line with typical seasonal averages, reflecting strong demand bolstered by a healthy labor market, strong wage growth and supporting demographic trends,“ said Selma Hepp, chief economist for CoreLogic. “Still, with a slower buying season ahead and the surging cost of homeownership, additional monthly price gains may taper off.”

Top Takeaways:

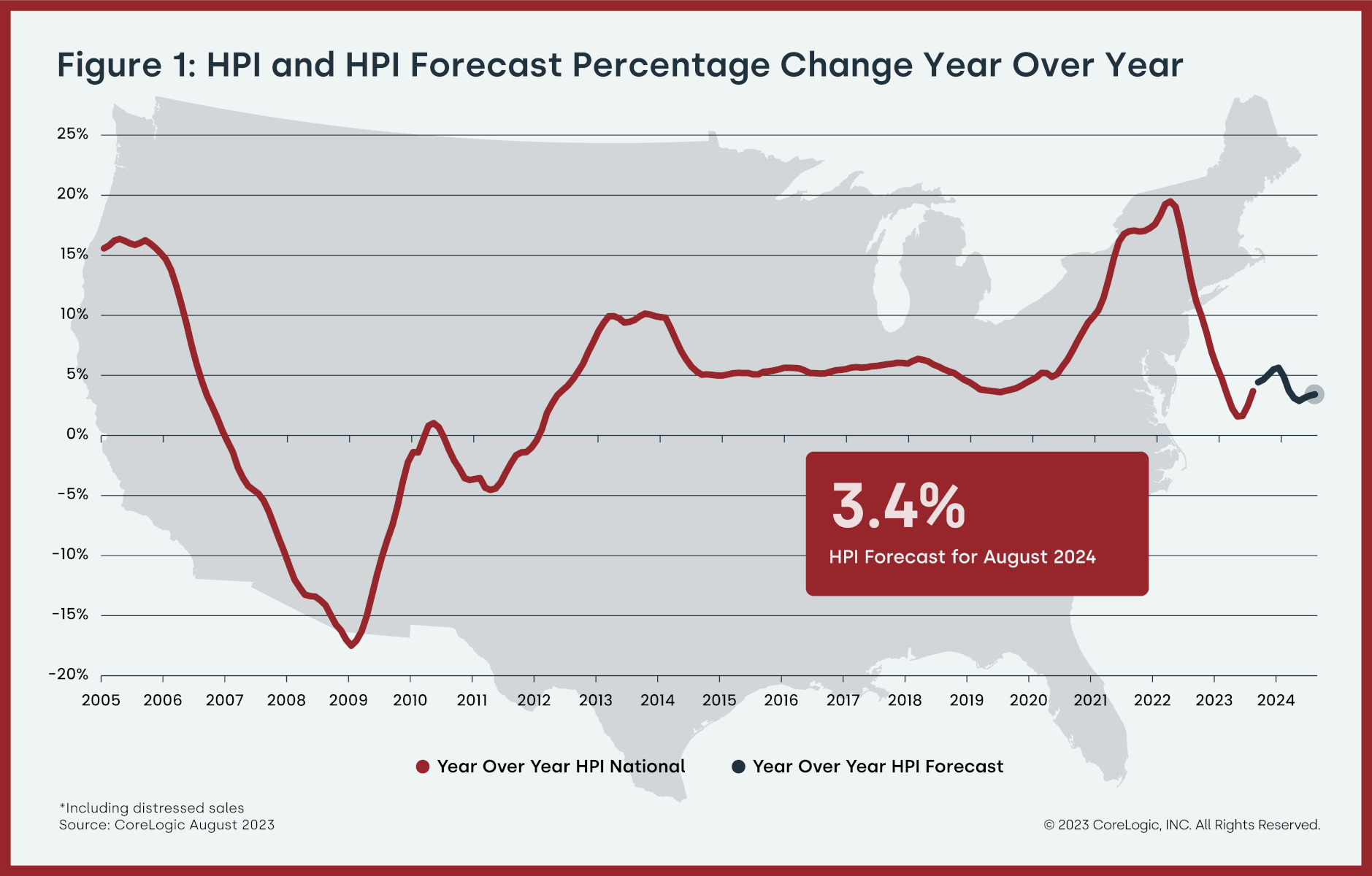

- U.S. home prices (including distressed sales) increased by 3.7% year over year in August 2023 compared with August 2022. On a month-over-month basis, home prices rose by 0.3% compared with July 2023.

- In August, the annual appreciation of detached properties (3.7%) was 0.2 percentage points higher than that of attached properties (3.5%).

- CoreLogic’s forecast shows annual U.S. home price gains at 3.4% by August 2024.

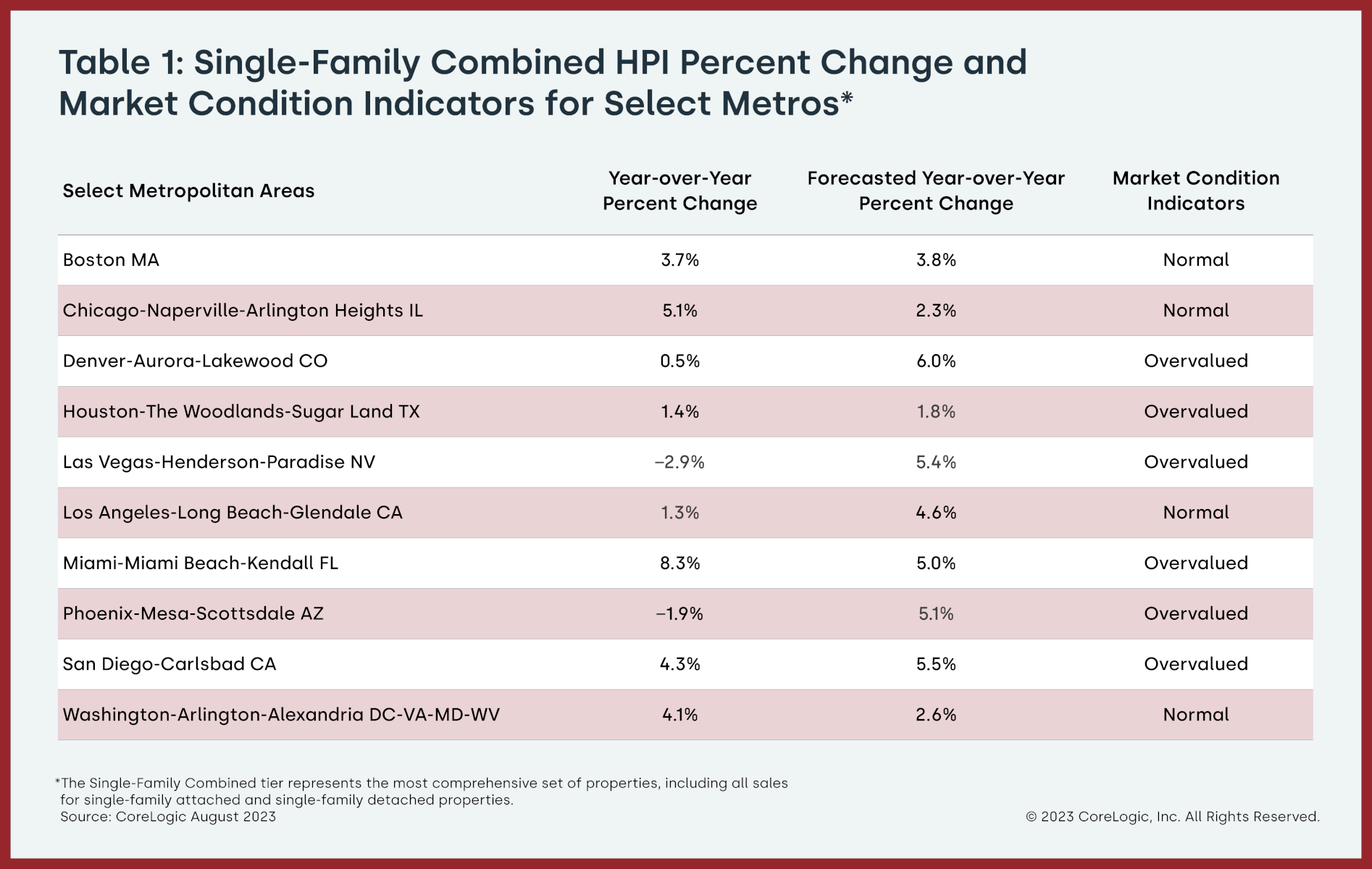

- Miami posted the highest year-over-year home price increase of the country’s 20 tracked metro areas in June, at 8.3%. St. Louis saw the next-highest gain (6.4%), followed by Charlotte, North Carolina (5.4%).

- Among states, New Hampshire ranked first for annual appreciation in July (up by 9.4%), followed by Maine and Vermont (both up by 8.9%). Eight states recorded home price losses: Idaho (-4%), Montana (-2.7%), Nevada (-2.3%), Utah (-2%), Washington (-1%), Arizona (-0.9%), Texas (-0.4%) and New York (-0.2%).

No related posts.