Buyers are getting some much-needed relief, and more homeowners appear to be breaking free of “rate lock,” according to the latest monthly report from Zillow®. Yet despite improvements in inventory, competition for homes is still relatively stiff.

“Buyers found significant savings as rates fell. But mortgage rates are fickle things, as we’ve seen in recent weeks, and they’ll play a massive role in determining appreciation and affordability — especially for first-time buyers — going forward in 2024,” said Skylar Olsen, Zillow chief economist. “Fortunately, rate lock appears to be wearing off for some homeowners, who show encouraging signs that they’re ready to come back to the market.”

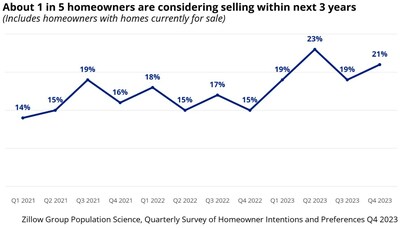

A recent Zillow survey of homeowners found that 21% are considering selling their home within the next three years. That’s up from 15% a year ago.

The survey, fielded in Q4 of 2023, also found that the share of homeowners considering selling was almost the same whether they had a mortgage rate above or below 5%.

That’s a big change from six months ago, when homeowners with rates above 5% were nearly twice as likely to consider selling.

The survey data shows that more owners with low rates are warming up to the idea of selling, while those with higher rates probably purchased their house fairly recently. Current mortgage rates look to be less of a determining factor when considering a sale.

A home purchase becomes affordable* again

Monthly payments for a new mortgage on a typical home are now $1,790 — that’s $143 less than in October. The drop has brought affordability back to home buying — by some definitions. For the first time since April, a new mortgage at 20% down now takes less than 33% of the median household income. But that’s a national average. Prices are so high that the median household can’t even qualify for a mortgage in many expensive metros. A 20% down payment is a high bar, too, especially for first-time buyers. Half of all buyers put less money down, and half of first-time buyers use either a gift or a loan from family or friends to fund their down payment.

The financial decision to buy or rent in 2024 won’t be one to take lightly. Those on the fence will need to answer some probing questions about their own savings and investment prowess, expectations for the market and how long they want to stay in one spot.

Inventory improves

Inventory continues to make slogging progress out of its pandemic hole. Inventory made its first annual gains since April, and levels are now 36% below pre-pandemic averages, an improvement over the 46% deficit seen in May.

The flow of new listings to the market is slightly better than a year before, and although levels are 14.5% below pre-pandemic norms, they seem to be trending in the right direction. Time will tell if that progress continues in 2024.

Competition continues

A lack of choices means buyers are unlikely to find price cuts, and they should expect competition for the most attractive listings. Price cuts are never popular in the winter, and this December, the share of listings with a price cut was just under 16% — the lowest since April 2022.

Although the market has cooled from the demand-fueled peaks of 2021 and 2022, listings are still going under contract in about a month — 50% faster than pre-pandemic norms. The latest Zillow data shows that nearly 30% of homes nationwide are selling for more than their original list price, compared to about 20% in 2018 and 2019.