“While sequential monthly rents have decreased for four straight months, we witnessed a slower decline from October to November, with rents down $6 or 0.4% compared to a decrease of 0.6% just 30 days prior,” said Jay Lybik, National Director of Multifamily Analytics at CoStar Group. “As market conditions slip further out of equilibrium with new deliveries far outpacing demand, we expect monthly rents to continue their downward trend.”

Multifamily Market Weakening Despite Positive Year over Year Rent Growth

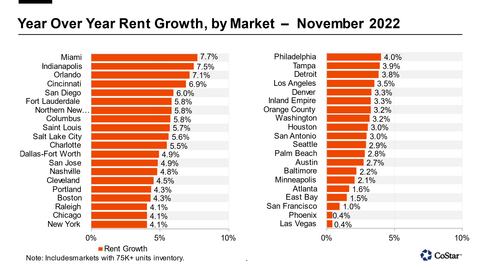

National year over year rents continued to remain positive but fell to 4.1% in November compared to 4.8% at the end of October. Miami held the top rent growth spot alongside Midwest and Gateway locations that have gained traction in recent weeks and currently hold positions in the top 10.

None of the top 40 largest markets saw their year over year asking rents expand in the month of November. Historically, the fourth quarter tends to be slower for multifamily, but we’re witnessing a weaker market overall with the downward rent growth and volatile market conditions.

Phoenix Sees Dramatic Slowing of Growth

The majority of markets with the fastest growing rents throughout 2021 are now seeing the quickest pullback. In particular, Phoenix and Las Vegas have both witnessed a dramatic slowing of growth and sit at the bottom of the annual rent growth ranking for November. Las Vegas’ year over year asking rents decreased from 22.0% in Q4 2021 to 0.4% at the end of November. Phoenix isn’t far behind with year over year rents dropping to 0.4% from 20.8% just eleven months earlier.

Sun Belt, Coastal California Round Out Worst Performing Rental Markets

Sequential rents month over month paint a stark picture of the deteriorating rent landscape. Only nine of the 40 largest markets saw month over month rents holding positive or at zero. In absolute terms, San Jose rents declined the most over the last 30 days, down $28 or 0.9%.

Sunbelt markets constitute five of the 10 worst performing rent growth markets over the past month, with Coastal California markets like the East Bay and San Diego also weakening. However, Raleigh takes the top spot in November with rents retreating by $17 or 1.1%. Seattle wasn’t far behind with a 1.0% rent decrease.