CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for December 2023.

U.S. annual single-family home price growth continued its gradual upward momentum in December 2023 to 5.5%. Northeastern states still saw the largest gains, although no states or districts posted year-over-year losses, the first time that the latter trend has been observed since late 2022. As noted in CoreLogic’s most recent Loan Performance Index report, a healthy job market continues to drive mortgage performance and housing demand. In January 2024, the country added 353,000 new jobs, according to current U.S. Bureau of Labor Statistics data. These economic and housing market dynamics are happening while the inventory of homes for sale remains slim.

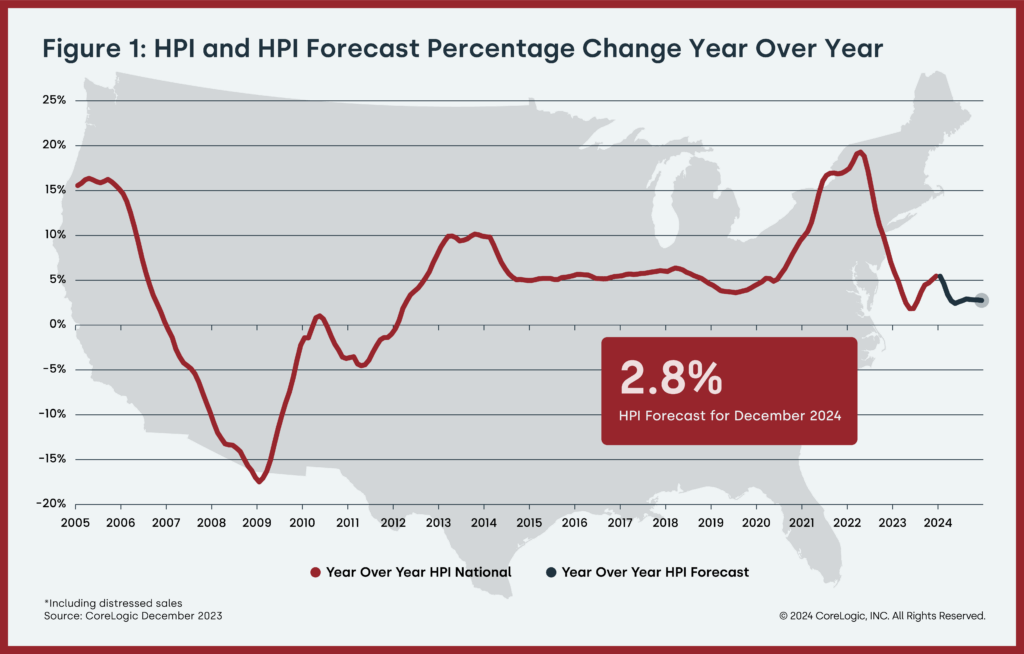

“Last winter’s mortgage rate surge impacted seasonal home price changes in many markets and suggests that annual gains may have reached the cycle peak and will level off in the coming months,” said Selma Hepp, chief economist for CoreLogic. “But while appreciation is projected to slow, home prices will continue to extend to new highs entering the typically busy spring homebuying season. Also, while the recent dip in mortgage rates help improve some affordability challenges, additional rate declines may not arrive until the second half of 2024.”

“The 2024 homebuying season should enjoy a boost because of pent-up demand, as well as a robust job market and wage growth,” Hepp continued. “Geographic patterns in price gains continued to favor housing markets in the Northeast and the South, especially those that remain more affordable and have lagged in home price increases over the past couple of years.”

Top Takeaways:

- U.S. single-family home prices (including distressed sales) increased by 5.5% year over year in December 2023 compared with December 2022. On a month-over-month basis, home prices declined by – 0.1% compared with November 2023.

- In December, the annual appreciation of detached properties (5.7%) was 1.1 percentage point higher than that of attached properties (4.6%).

- CoreLogic’s forecast shows annual U.S. home price gains slowing to 2.8% in December 2024.

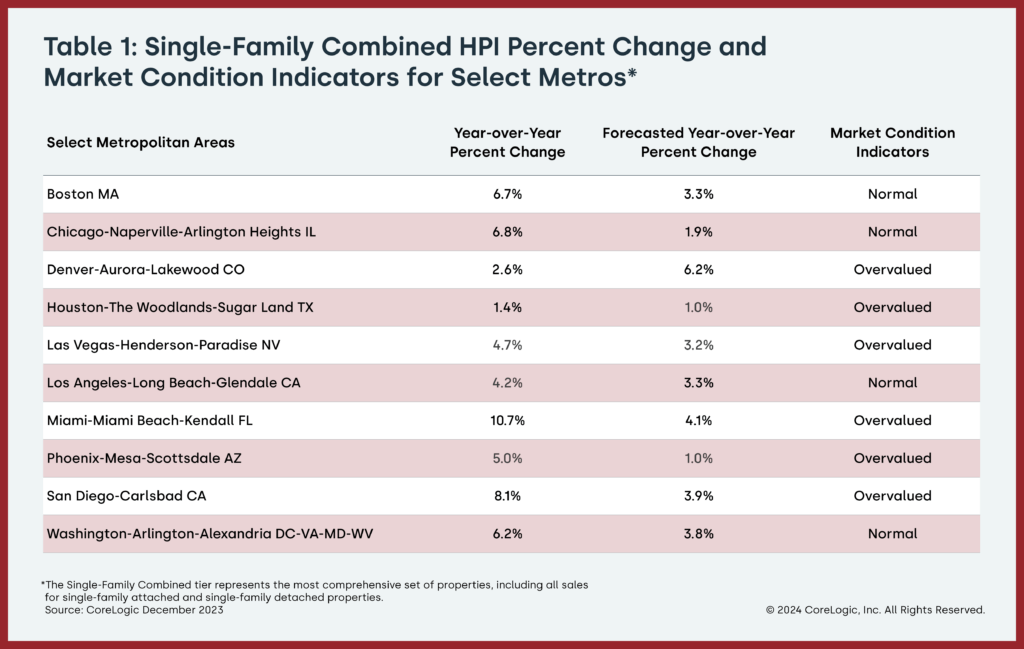

- Miami posted the highest year-over-year home price increase of the country’s 20 tracked metro areas in December, at 10.7%. Detroit saw the next-highest gain (9.3%), followed by San Diego (8.1%).

- Among states, Rhode Island ranked first for annual appreciation in December (up by 13.3%), followed by New Jersey (up by 11.3%) and Connecticut (up by 10.5%). No states recorded year-over-year home price losses.

The next CoreLogic HPI press release, featuring January 2024 data, is scheduled to be issued on March 5, 2024, at 8 a.m. EST.

No related posts.