Workers saw record hourly earnings growth and employment levels continued to rise as 2021 drew to a close. This is according to the aggregated payroll data of approximately 350,000 Paychex clients with fewer than 50 employees, released monthly in the Paychex | IHS Markit Small Business Employment Watch. The December data shows hourly earnings growth improved to 4.27 percent, the highest level since reporting began ten years ago. Hiring at small businesses also ended the year on a high note with the Small Business Jobs Index improving 7.31 percent from the prior year and 0.22 percent for the month.

“Small business employment continues to rise as we end 2021, contributing jobs and rapid earnings growth to our sharp recovery from the COVID-19 downturn,” said James Diffley, chief regional economist at IHS Markit.

“Over the past several months, we’ve seen steady and sustained increases in our hourly earnings growth. In December, average hourly earnings reached $30.00, ” said Martin Mucci, Paychex CEO. “Employers are responding to the pressures of the tight labor market by raising wages and workers are benefiting.”

In further detail, the December report showed:

- Hourly earnings growth and weekly earnings growth are both above four percent. Each measure was at less than three percent growth as recently as June.

- Hourly earnings grew 4.27 percent during 2021, resulting in an average hourly wage of $30.00.

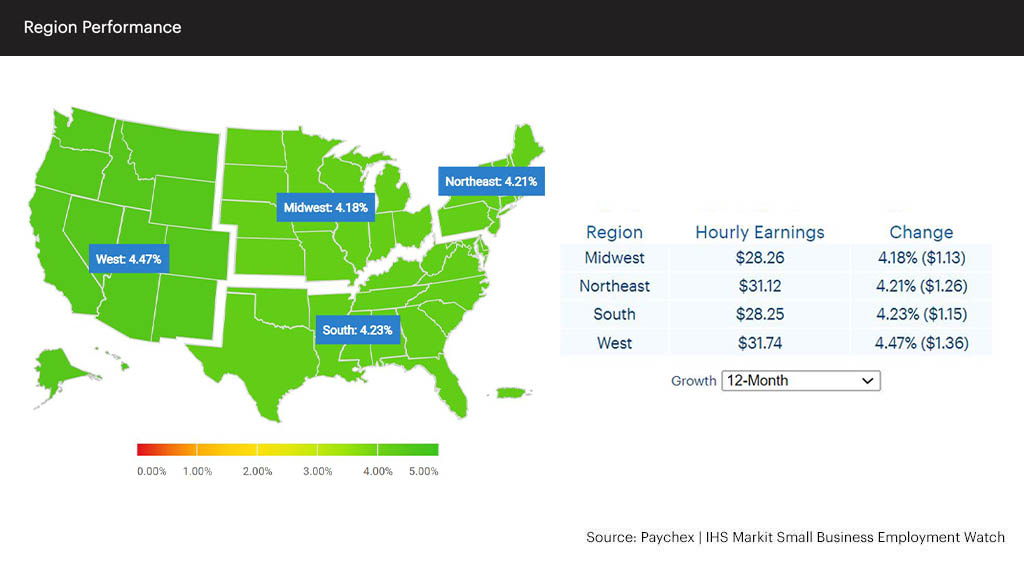

- Hourly earnings growth exceeded four percent in all regions of the U.S.

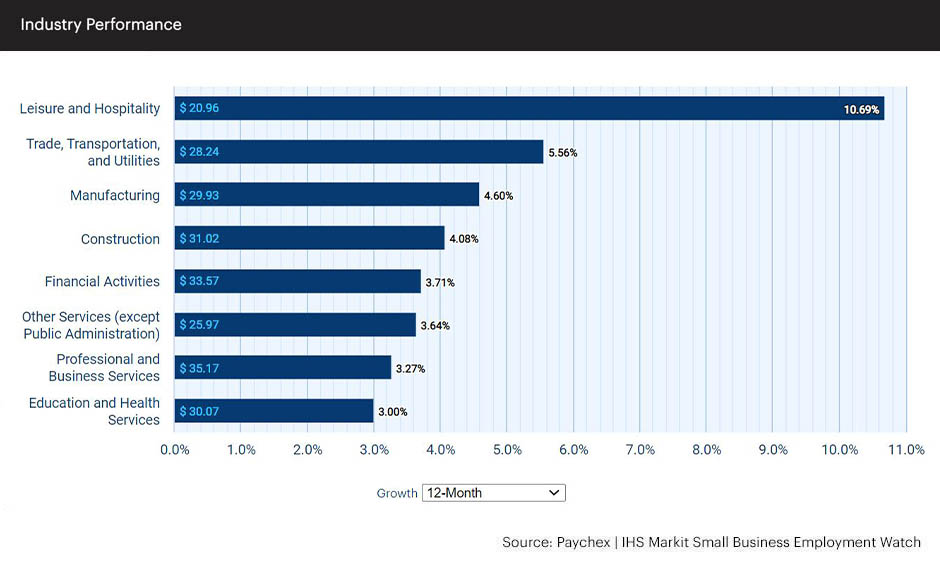

- Leisure and hospitality hit double-digit hourly earnings growth (10.69 percent) to lead all industry sectors.

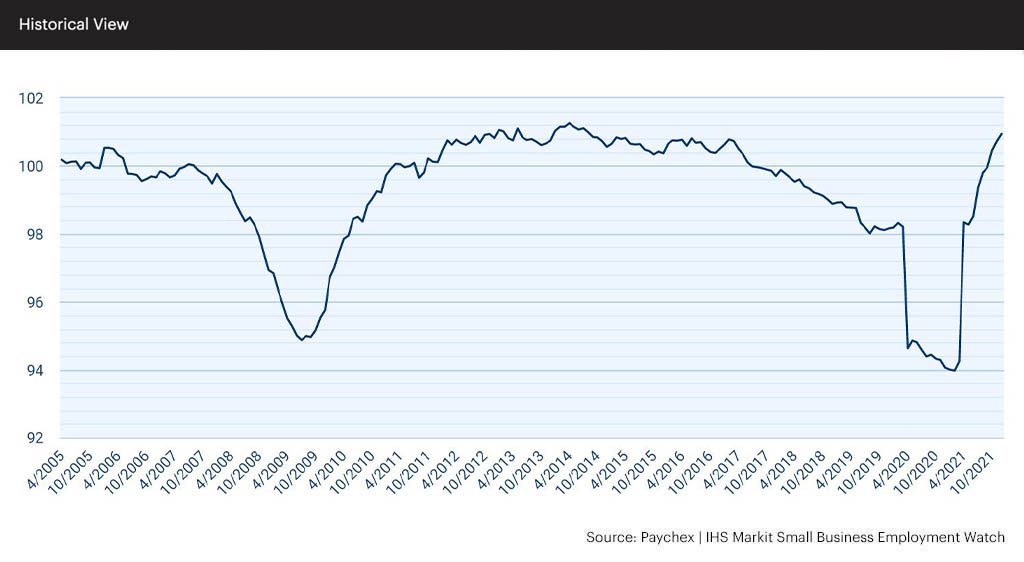

- The Small Business Jobs Index increased to 100.94 in December, its highest level since August 2014. The rate of growth, however, has slowed for the past two months (0.50 percent in October, 0.27 percent in November, and 0.22 percent in December).

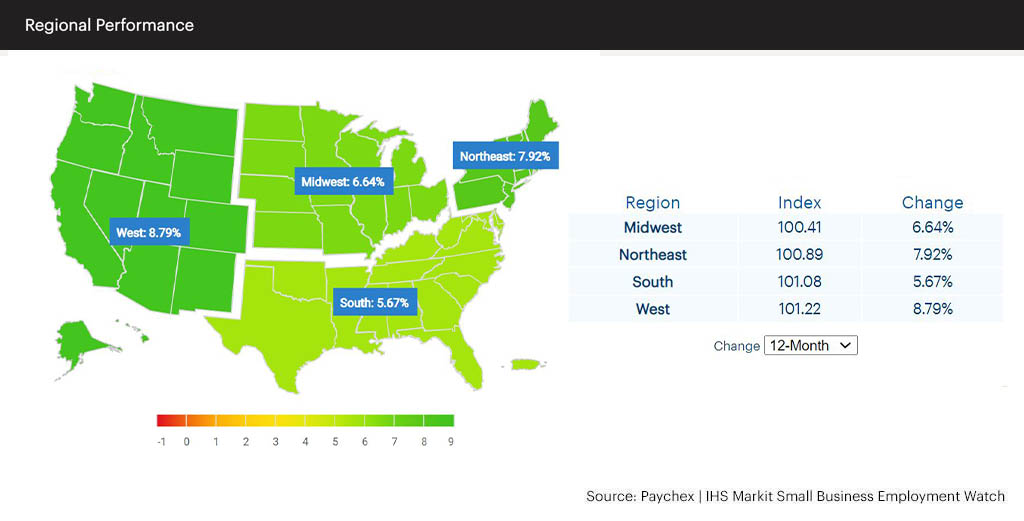

- The West overtook the South as the top region for small business employment growth.

- Texas remained the top state for small business hiring, and Dallas the top metro.

Paychex business solutions reach 1 in 12 American private-sector employees, making the Small Business Employment Watch an industry benchmark. Drawing from the payroll data of approximately 350,000 Paychex clients with fewer than 50 employees, the monthly report offers analysis of national employment and wage trends, as well as examines regional, state, metro, and industry sector activity.

The complete results for December, including interactive charts detailing all data, are available at www.paychex.com/watch. Highlights are available below.

December 2021 Paychex | IHS Markit Small Business Employment Watch

National Jobs Index

- The national index added another strong gain (0.22 percent), increasing from 100.72 in November to 100.94 in December.

- The national index recorded its seventh consecutive gain to end 2021.

- The national index has gained a record high 7.31 percent during the past 12 months as small businesses continue to recover from the coronavirus pandemic.

National Wage Report

- Rising to $30.00 in December, hourly earnings gained $1.23 (4.27 percent) during 2021.

- Weekly earnings growth improved to 4.14 percent in December, joining hourly gains of 4.27 percent. Both measures were less than three percent as recently as June.

- While year-over-year growth remains slightly negative (0.16 percent), weekly hours worked have increased for three consecutive months.

Regional Jobs Index

- At 101.22, the West has the highest regional index in December and improved for the tenth consecutive month.

- The South (101.08) fell to second among regions and was the only region to slow in December, largely due to a decrease (0.43 percent) in the East South Central division.

- With the Midwest gaining 0.49 percent in December, each regional index is above 100.

Regional Wage Report

- Hourly earnings growth in December exceeded four percent in all regions.

- With the national earnings now at $30/hour, differences can be seen by region. The Midwest and South are slightly over $28/hour, while the West and Northeast are above $31/hour.

- Weekly hours worked growth is up 0.02 percent in the Northeast, the only region with positive year-over-year growth. All regions, however, are trending in a positive direction with one-month annualized growth over two percent.

State Jobs Index

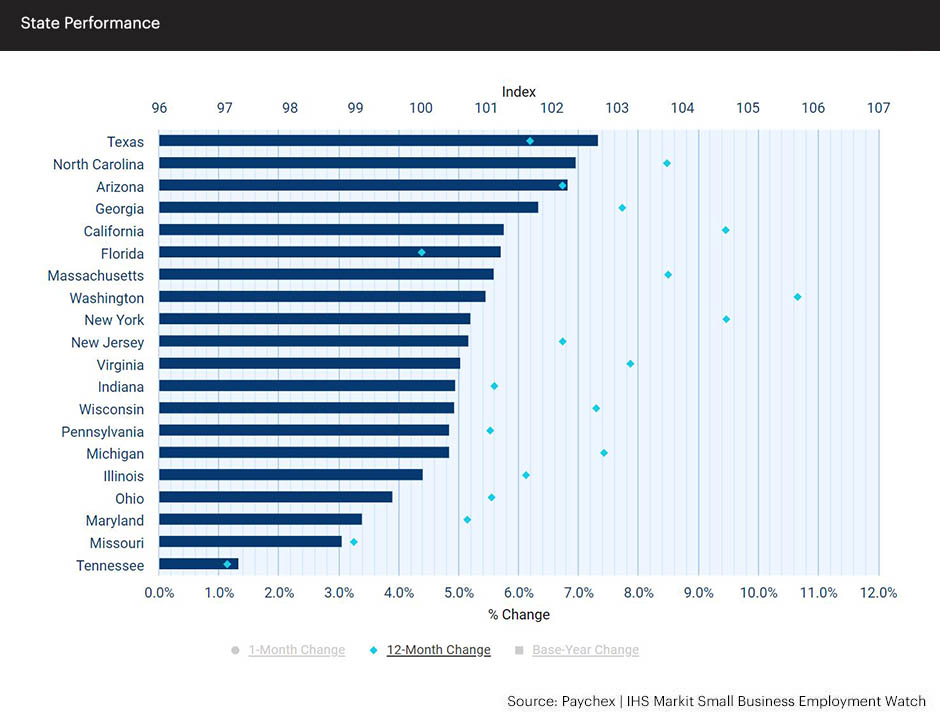

- Once again, Texas, North Carolina, and Arizona each had index levels that exceeded 102.

- The index levels for Michigan and Illinois passed the 100 mark in December for the first time since 2018.

- Tennessee (97.23) fell 1.03 percent in December, solidifying its place at the bottom of the state rankings for the year. While most states have steadily recovered, the Tennessee index slowed in 10 out of the 12 months of 2021.

- New York posted its tenth index increase of 2021, gaining 0.41 percent to 100.77. New York ranks in the top ten among states for the first time since 2016.

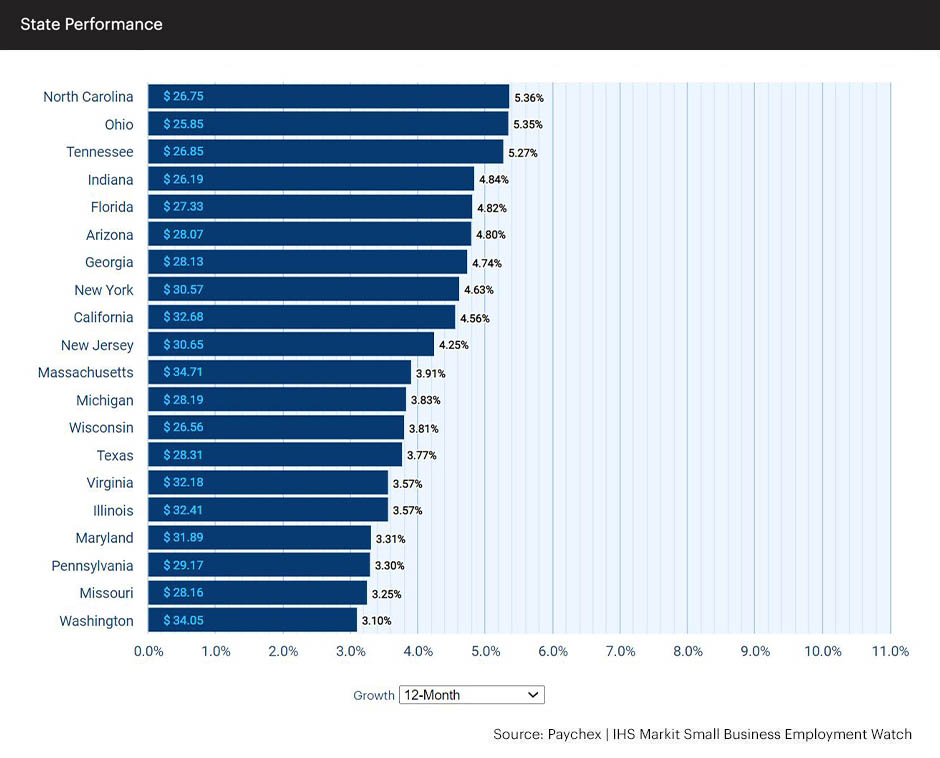

State Wage Report

- Weekly earnings growth in Florida improved to 5.01 percent, the only state above five percent.

- North Carolina, Ohio, and Tennessee reported hourly earnings growth above five percent in December, topping the state rankings. The same states each ranked in the bottom five for weekly hours worked growth.

- Michigan (2.44 percent) and Maryland (2.54 percent) are the only two states with weekly earnings growth below three percent.

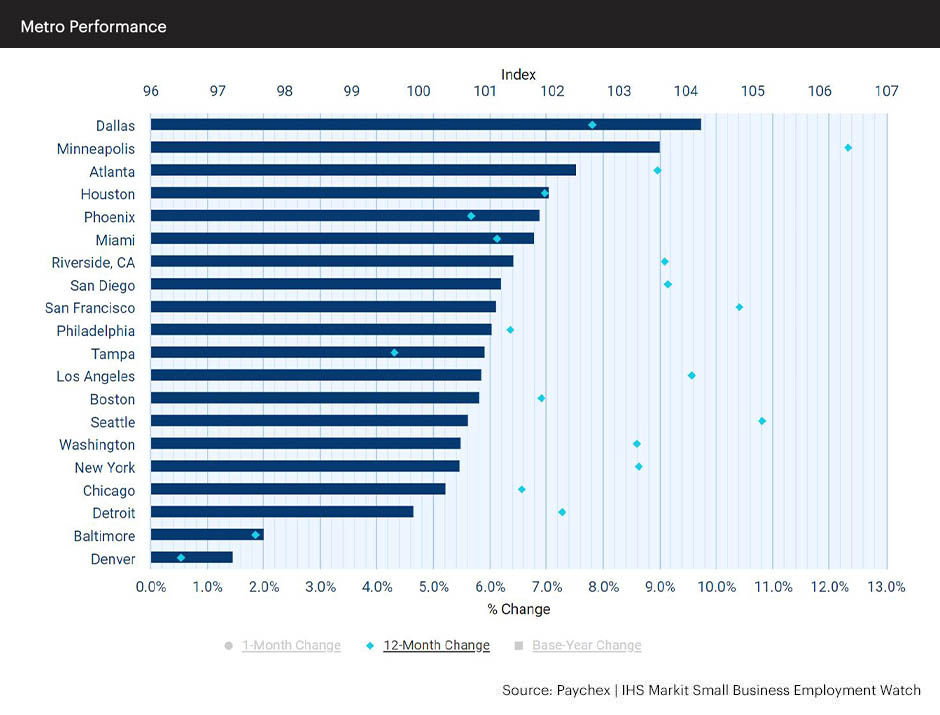

Metropolitan Jobs Index

- Dallas remained the top metro for small business job growth for the fourth consecutive month, with an index level consistently above 104.

- Minneapolis jumped 1.76 percent in December, its fourth increase of more than one percent in 2021. At 103.63, the Minneapolis index trails only Dallas and is up 12.33 percent from last year, best among metros.

- Denver fell 1.72 percent in December to 97.24, making its index last among metros. After ranking seventh among metros in June, Denver has steadily fallen during the past two quarters of 2021.

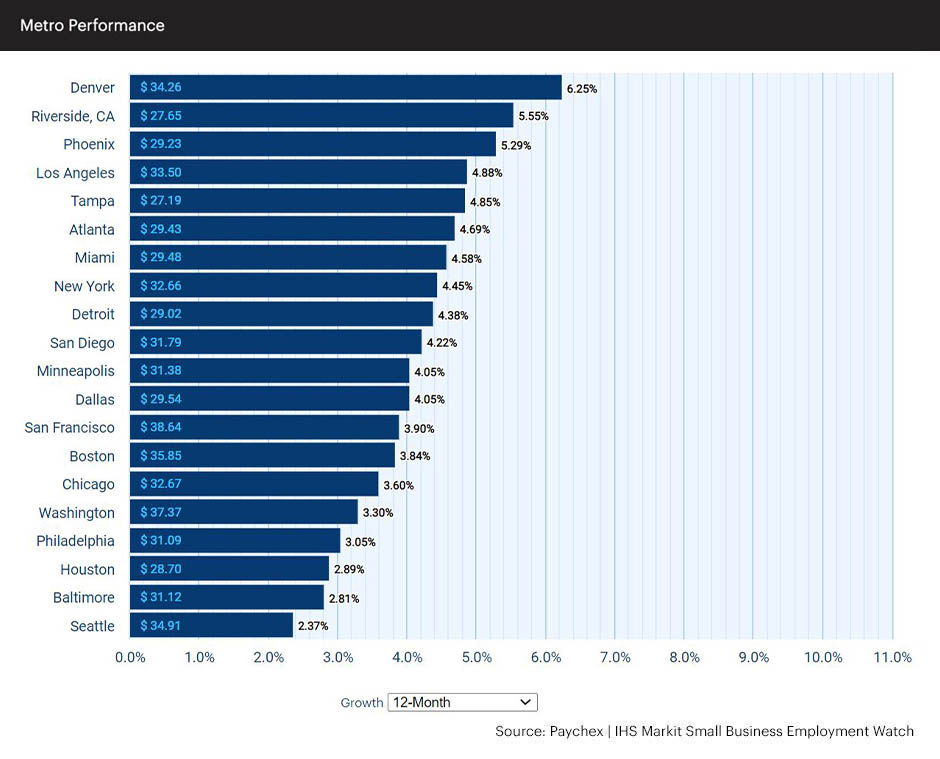

Metropolitan Wage Report

- Denver topped all metros in hourly and weekly earnings growth, both above six percent. However, Denver has the lowest index among metros for small business employment growth.

- Seattle, Baltimore, and Houston are the only three metros with hourly earnings growth below three percent.

- Houston ranks first among metros for weekly hours worked growth, increasing 0.80 percent in December.

- Weekly hours worked growth is trending in the right direction as ten of the twenty metros analyzed now have positive year-over-year growth, up from just three metros in November.

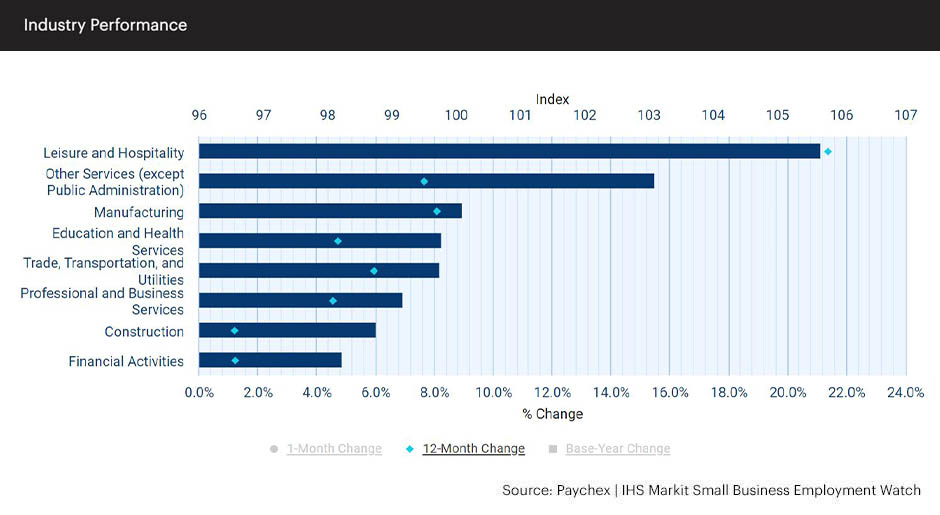

Industry Jobs Index

- The leisure and hospitality index (105.68) gained 1.39 percent in December and 21.36 percent during the past year.

- With four industries decreasing in December (construction, education and health services, manufacturing, and financial activities), the national increase was heavily influenced by strong gains in leisure and hospitality and other services (except public administration).

- Construction and financial activities ended 2021 with index levels below 99, recovering only a little more than one percent during the year.

Industry Wage Report

- Leisure and hospitality hit double-digit hourly earnings growth (10.69 percent) to lead all sectors. Trade, transportation, and utilities ranks second at 5.56 percent.

- With education and health services improving to 3.00 percent in December, all sectors have hourly earnings growth at or above three percent.

- Weekly earnings growth is just 2.18 percent in the education and health services industry, six times lower than the leisure and hospitality growth rate (13.29 percent).

Note: Analysis is provided for seven major industry sectors. Definitions of each industry sector can be found here. The other services (except public administration) industry category includes religious, civic, and social organizations, as well as personal services, including automotive and household repair, salons, drycleaners, and other businesses.

The Paychex | IHS Markit Small Business Employment Watch is released each month by Paychex, Inc., a leading provider of payroll, human resource, insurance, and benefits outsourcing solutions for small-to medium-sized businesses, and IHS Markit, a world leader in critical information, analytics, and expertise. Focused exclusively on small business, the monthly report offers analysis of national employment and wage trends, as well as examines regional, state, metro, and industry sector activity. Drawing from the payroll data of approximately 350,000 Paychex clients, this powerful tool delivers real-time insights into the small business trends driving the U.S. economy.