CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for January 2024.

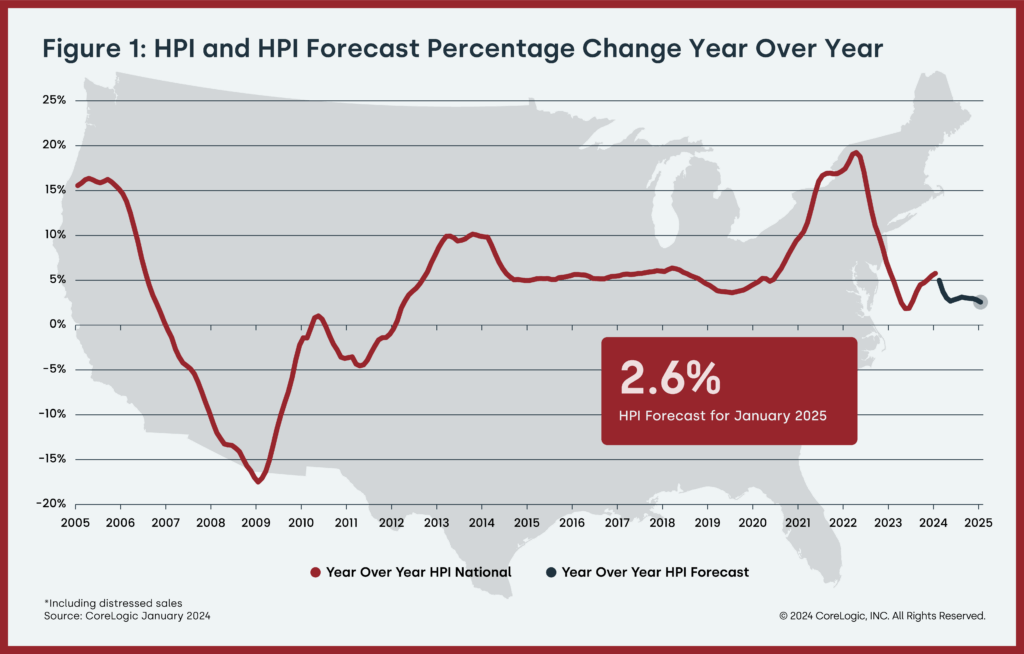

Year-over-year home price gains reached the highest rate in a year in January, but growth is expected to begin slowing in the coming months, falling to 2.6% by early 2025. Both higher mortgage rates and inventory shortages are exacerbating the nation’s long-running housing affordability problem, which particularly affects areas of the country where wages tend to be lower. Despite affordability issues, many younger Americans are finding a path to homeownership, with millennials accounting for more than half of home purchase applications between 2020 and 2023. Meanwhile, baby boomers who already have significant financial reserves can pay for homes entirely in cash, which further increases challenges for other buyers.

“U.S. annual home price growth strengthened to 5.8% in January 2024,” said Dr. Selma Hepp, chief economist for CoreLogic. “And while the acceleration continues to reflect the residual impact of strong appreciation in early 2023, the annual rate of growth is expected to taper off in coming months.”

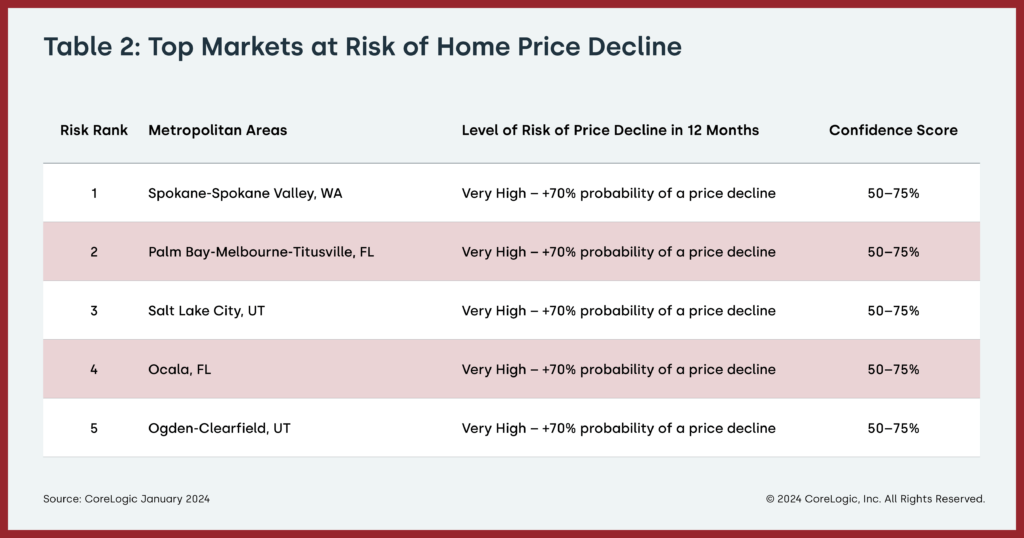

“Home prices further increased in late 2023 despite high mortgage rates, which surged to the highest level since the beginning of the millennium,” Hepp continued. “But metro areas that have struggled with the impact of higher rates continue to see downward movement on home prices. Generally, pressures from higher mortgage rates tend to occur in markets where the higher cost of homeownership pushes against the affordability ceiling.”

Top Takeaways:

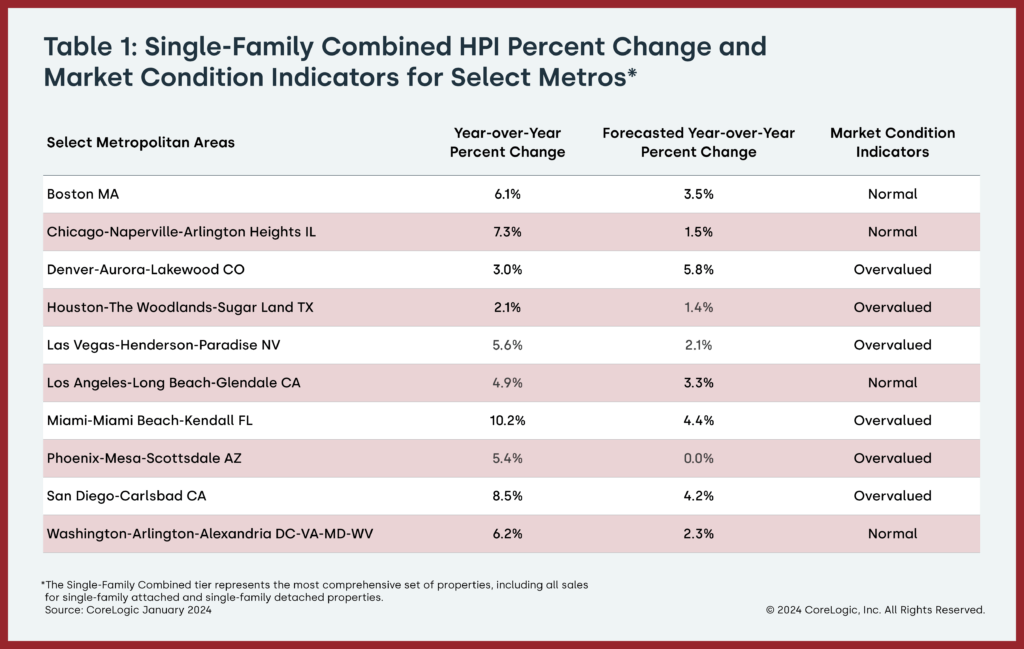

- Metro Phoenix foretasted year-over-year to not change.

- U.S. single-family home prices (including distressed sales) increased by 5.8% year over year in January 2024 compared with January 2023. On a month-over-month basis, home prices increased by 0.1% compared with December 2023.

- In January, the annual appreciation of detached properties (6%) was 1.1 percentage points higher than that of attached properties (4.9%).

- CoreLogic’s forecast shows annual U.S. home price gains relaxing to 2.6% in January 2025.

- Miami posted the highest year-over-year home price increase of the country’s 10 highlighted metro areas in January, at 10.2%. San Diego saw the next-highest gain at 8.5%.

- Among states, Rhode Island ranked first for annual appreciation in January (up by 13.2%), followed by New Jersey (up by 11.6%) and Connecticut (up by 11%). No states recorded year-over-year home price losses.

The next CoreLogic HPI press release, featuring February 2024 data, is scheduled to be issued on April 2, 2024, at 8 a.m. EST.

No related posts.