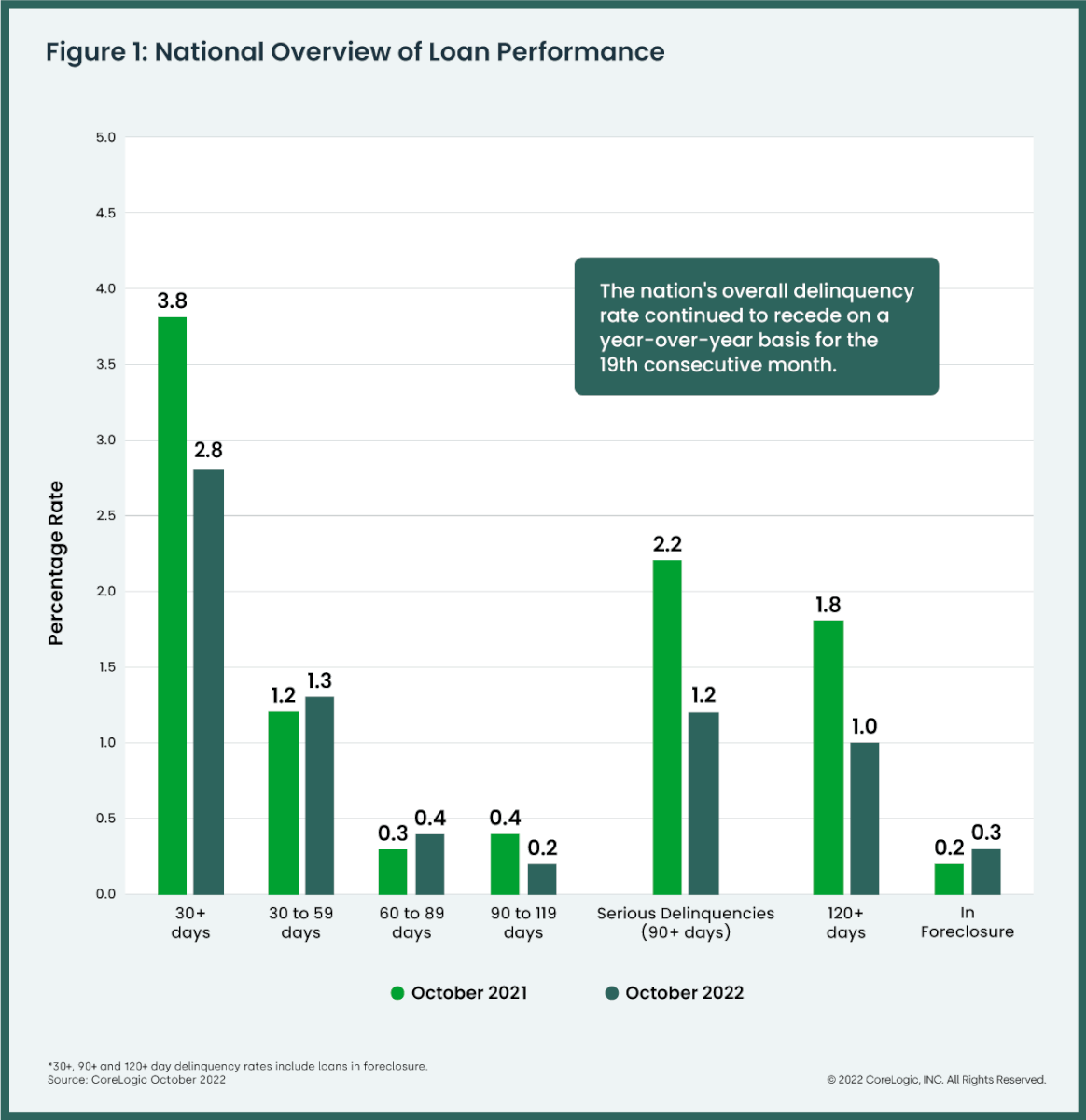

For the month of October, 2.8% of all mortgages in the U.S. were in some stage of delinquency (30 days or more past due, including those in foreclosure), representing a 1 percentage point decrease compared to 3.8% in October 2021.

To gain a complete view of the mortgage market and loan performance health, CoreLogic examines all stages of delinquency. In October 2022, the U.S. delinquency and transition rates, and their year-over-year changes, were as follows:

- Early-Stage Delinquencies (30 to 59 days past due): 1.3%, up from 1.2% in October 2021.

- Adverse Delinquency (60 to 89 days past due): 0.4%, up from 0.3% in October 2021.

- Serious Delinquency (90 days or more past due, including loans in foreclosure): 1.2%, down from 2.2% in October 2021 and a high of 4.3% in August 2020.

- Foreclosure Inventory Rate (the share of mortgages in some stage of the foreclosure process): 0.3%, up from 0.2% in October 2021.

- Transition Rate (the share of mortgages that transitioned from current to 30 days past due): 0.7%, unchanged from October 2021.

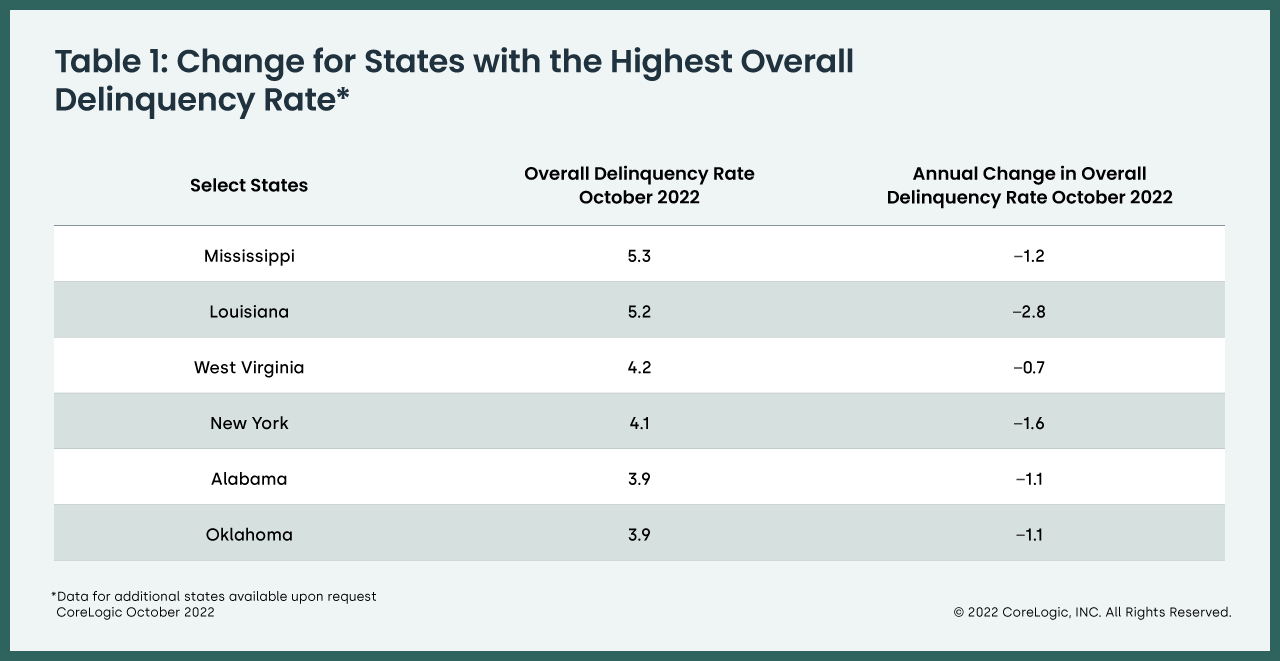

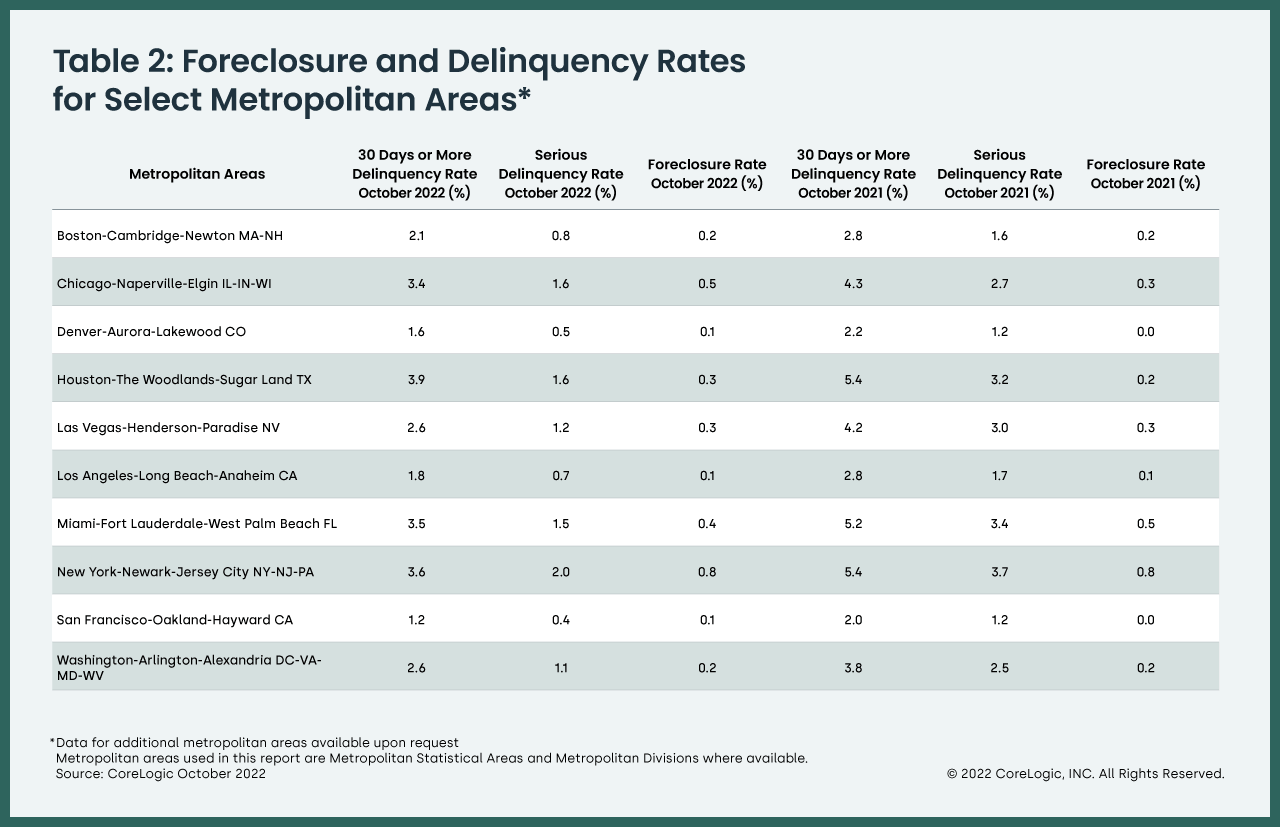

The number of borrowers who were at least 30 days late on their mortgage payments remained at 2.8% for the third straight month in October, still near the lowest delinquency rate seen in more than two decades. The U.S. foreclosure rate also hovered near a record low, holding at 0.3% for the eighth consecutive month. While all states saw at least small year-over-year declines in overall mortgage delinquency rates, six metro areas posted annual upticks. These include two metros on Florida’s Gulf Coast, close to where Hurricane Ian made landfall in late September, causing an estimated $28 billion to $47 billion in property damage throughout the state.

“The share of loans in early-stage delinquency increased slightly in October, led by Florida, which began to see the effects of Hurricane Ian,” said Molly Boesel, principal economist at CoreLogic. “The Punta Gorda and Cape Coral metro areas on Florida’s Gulf Coast saw early-stage mortgage delinquencies triple. If past storm impacts are an accurate barometer, delinquencies in these metros should decrease between the next six to 12 months.”

State and Metro Takeaways:

- In October, all states posted annual declines in overall delinquency rates. The states with the largest declines were Louisiana (down 2.8 percentage points) and New York and New Jersey (both down 1.6 percentage points). The remaining states, including the District of Columbia, registered annual delinquency rate drops between 1.5 percentage points and 0.2 percentage points.

- Six U.S. metro areas posted an increase in overall delinquency rates. Mortgage delinquencies rose from October 2021 in Punta Gorda, Florida (up 1.9 percentage points); Cape Coral-Fort Myers, Florida (up 1.8 percentage points); Iowa City, Iowa (up 0.4 percentage points); Cedar Rapids, Iowa and Lima, Ohio (both up 0.2 percentage points) and Decatur, Illinois (up 0.1 percentage points).

- All U.S. metro areas posted at least a small annual decrease in serious delinquency rates, with Odessa, Texas (down 3.7 percentage points) and Midland, Texas and Laredo, Texas (both down 2.6 percentage points) posting the largest decreases.

Methodology

The data in The CoreLogic LPI report represents foreclosure and delinquency activity reported through October 2022. The data in this report accounts for only first liens against a property and does not include secondary liens. The delinquency, transition and foreclosure rates are measured only against homes that have an outstanding mortgage. Homes without mortgage liens are not subject to foreclosure and are, therefore, excluded from the analysis. CoreLogic has approximately 75% coverage of U.S. foreclosure data.

No related posts.