CoreLogic, a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for November 2021.

While 2021 was a record-breaking year for U.S. home price growth, for many prospective buyers the hot housing market will continue to exacerbate ongoing affordability challenges into the new year — and beyond. Though home price growth remains at historic highs, it is projected to slow over the next year. However, economic growth and inflation will most likely lead to increases in mortgage rates, which will further erode affordability.

“Over the past year, we have seen one of the most robust seller’s markets in a generation,” said Frank Martell, president and CEO of CoreLogic. “While increased interest rates may help cool down homebuying activity, we expect 2022 to be another strong year with continuing upward price growth.”

Top Takeaways:

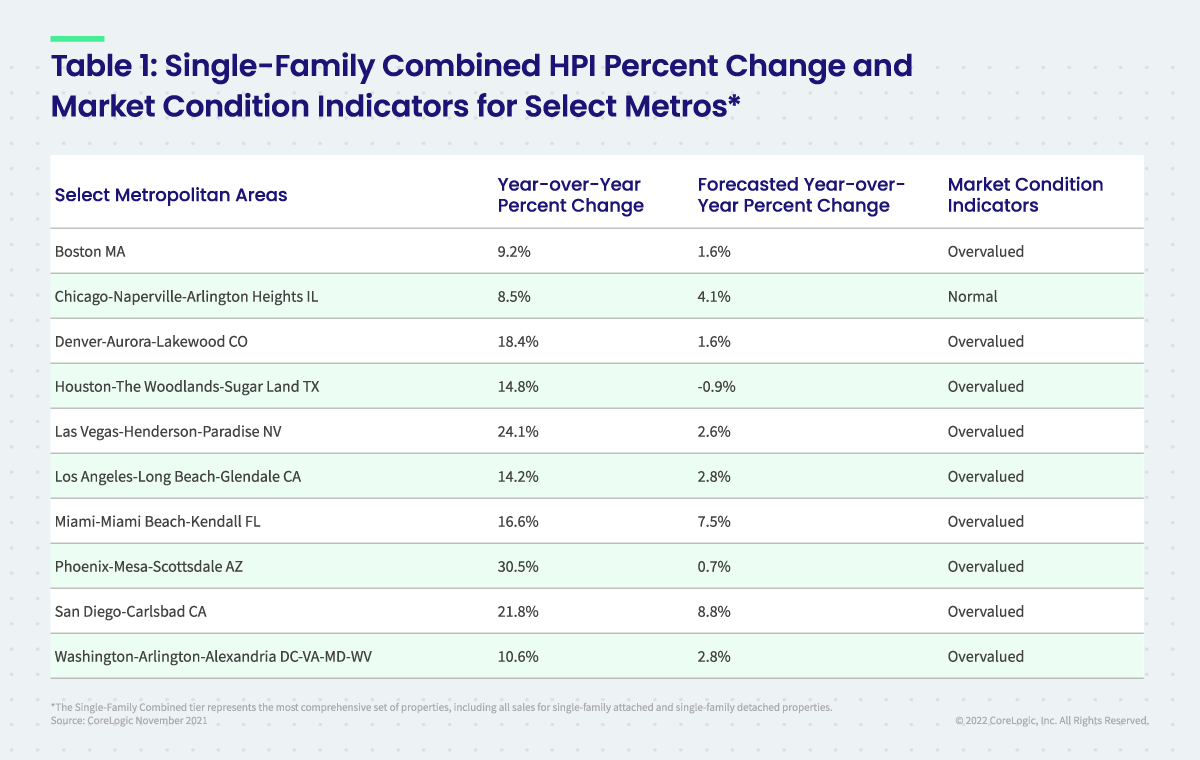

- Nationally, home prices increased 18.1% in November 2021, compared to November 2020. On a month-over-month basis, home prices increased by 1.3% compared to October 2021.

- In November, annual appreciation of detached properties (19.4%) was 5.8 percentage points higher than that of attached properties (13.6%).

- Home price gains are projected to slow to a 2.8% increase by November 2022.

- In November, Naples, Florida, logged the highest year-over-year home price increase at 36.7%. Twin Falls, Idaho, had the second-highest ranking at a 33.3% year-over-year increase.

- At the state level, the Southeast and Mountain West regions continued to dominate the top spot, with Arizona leading the way with the strongest price growth at 28.6%. Florida ranked second place with a 25.8% growth, pushing Idaho from second to third place at 25.5%.

“Interest rates on 30-year fixed-rate mortgages averaged a record low of 2.96% during 2021, helping to keep monthly payments low in the face of record-high home prices,” said Dr. Frank Nothaft, chief economist at CoreLogic. “However, the Federal Reserve appears poised to allow interest rates to rise in 2022. Higher rates will intensify buyer affordability challenges, especially in overvalued local markets.”

The next CoreLogic HPI press release, featuring December 2021 data, will be issued on February 1, 2022, at 8 a.m. ET.

Methodology

The CoreLogic HPI™ is built on industry-leading public record, servicing and securities real-estate databases and incorporates more than 45 years of repeat-sales transactions for analyzing home price trends. Generally released on the first Tuesday of each month with an average five-week lag, the CoreLogic HPI is designed to provide an early indication of home price trends by market segment and for the “Single-Family Combined” tier, representing the most comprehensive set of properties, including all sales for single-family attached and single-family detached properties. The indices are fully revised with each release and employ techniques to signal turning points sooner. The CoreLogic HPI provides measures for multiple market segments, referred to as tiers, based on property type, price, time between sales, loan type (conforming vs. non-conforming) and distressed sales. Broad national coverage is available from the national level down to ZIP Code, including non-disclosure states.

CoreLogic HPI Forecasts™ are based on a two-stage, error-correction econometric model that combines the equilibrium home price—as a function of real disposable income per capita—with short-run fluctuations caused by market momentum, mean-reversion, and exogenous economic shocks like changes in the unemployment rate. With a 30-year forecast horizon, CoreLogic HPI Forecasts project CoreLogic HPI levels for two tiers — “Single-Family Combined” (both attached and detached) and “Single-Family Combined Excluding Distressed Sales.” As a companion to the CoreLogic HPI Forecasts, Stress-Testing Scenarios align with Comprehensive Capital Analysis and Review (CCAR) national scenarios to project five years of home prices under baseline, adverse and severely adverse scenarios at state, metropolitan areas and ZIP Code levels. The forecast accuracy represents a 95% statistical confidence interval with a +/- 2% margin of error for the index.

No related posts.