CoreLogic Reports a

- An estimated 0.83% of all mortgage applications contained fraud, about 1 in 120 applications

- Investment properties accounted for the highest-risk applications

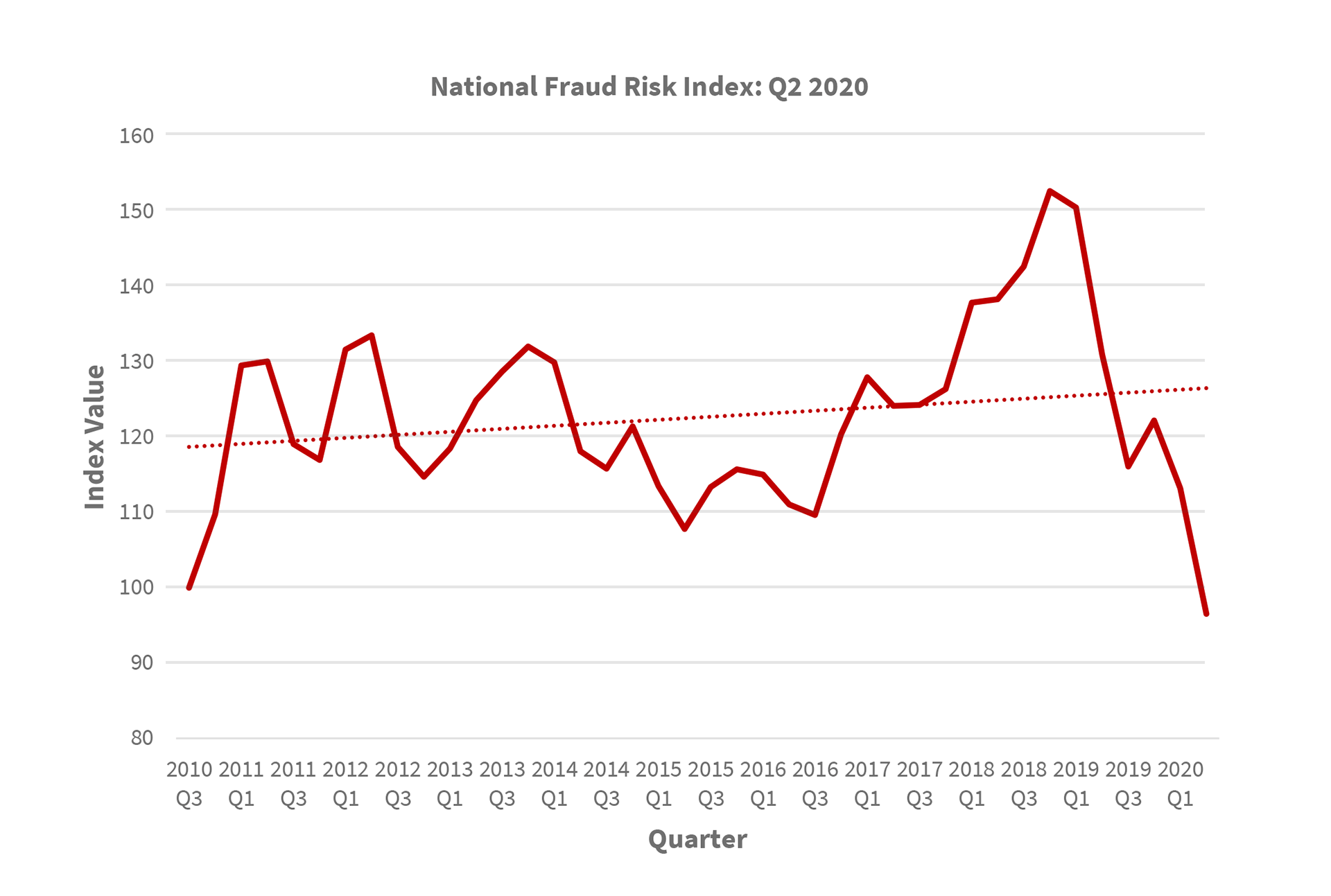

CoreLogic, a leading global property information, analytics and data-enabled solutions provider, today released its latest Mortgage Fraud Report. The report shows a 37.2% year-over-year increase in fraud risk at the end of the second quarter of 2021, as measured by the CoreLogic Mortgage Application Fraud Risk Index. The significant increase for mid-2021 follows a large drop seen in 2020 – a decrease driven mainly by the surge in traditionally low-risk refinances during the pandemic. The current risk level is similar to mid-2019.

During the second quarter of 2021, an estimated 0.83% of all mortgage applications contained fraud, about 1 in 120 applications. By comparison, in the second quarter of 2020, the estimate was 0.61%, or about 1 in 164 applications. Continued low mortgage rates and a record volume of refinances pushed the overall fraud risk down. However, risk in the purchase segment increased 6%, with investment properties driving the highest risk in both purchase and refinance populations.

“Refinance opportunities that surged lending volumes during the pandemic may be winding down. The outlook is for fewer low-risk refinances compared to purchases and cash-out refinances, which translates to a higher-risk environment for fraud,” said Ann Regan, executive, product management at CoreLogic.

Report Highlights:

- Nationally, most fraud types showed increased risk. Transaction risk showed an increase of 34.2% year-over-year. Income and property fraud risk decreased slightly, aligning with the strong job market and home price growth.

- The top five states for risk increases include: South Dakota, Washington, Alaska, Vermont and West Virginia. Less-populous states are more volatile due to lower levels of lending activity. These states all had below-average index values in 2020.

- Nevada moved into the top position for mortgage application fraud risk, with New York, Hawaii, Florida, and California rounding out the top five.

Figure 1: National Mortgage Origination Fraud Index (Q3 2010 – Q2 2021)

The CoreLogic Mortgage Fraud Report analyzes the collective level of loan application fraud risk experienced in the mortgage industry each quarter. CoreLogic develops the index based on residential mortgage loan applications processed by CoreLogic LoanSafe Fraud Manager™, a predictive scoring technology. The report includes detailed data for six fraud type indicators that complement the national index: identity, income, occupancy, property, transaction and undisclosed real estate debt.

Methodology

Our comprehensive fraud risk analysis is based on a lender-driven mortgage fraud consortium and leading predictive-scoring technology.

The CoreLogic Mortgage Application Fraud Risk Index represents the collective level of fraud risk the mortgage industry is experiencing in each period, based on the share of loan applications with a high risk of fraud. The index is standardized to a baseline of 100 for the share of high-risk loan applications nationally in the third quarter of 2010.

The Fraud Type Indicators are based on specific CoreLogic LoanSafe Fraud Manager alerts. These alerts are compiled consistently for all CoreLogic Mortgage Fraud Consortium members. Indicator levels are based on the prevalence and predictive ability of the relevant alerts. An increase in the indicator correlates with increased risk of the corresponding fraud type.

No related posts.