The U.S. Commerce Department’s Section 232 investigation into semiconductor imports has significant implications for Arizona’s burgeoning semiconductor ecosystem. As the state advances its position as a domestic semiconductor manufacturing hub, the investigation’s outcomes could reshape the landscape for local manufacturers and suppliers. Strategic alignment with federal industrial policy and proactive state-level investments are critical levers in sustaining Arizona’s growth and leadership in the semiconductor industry.

Turbulence in the Supply Chain

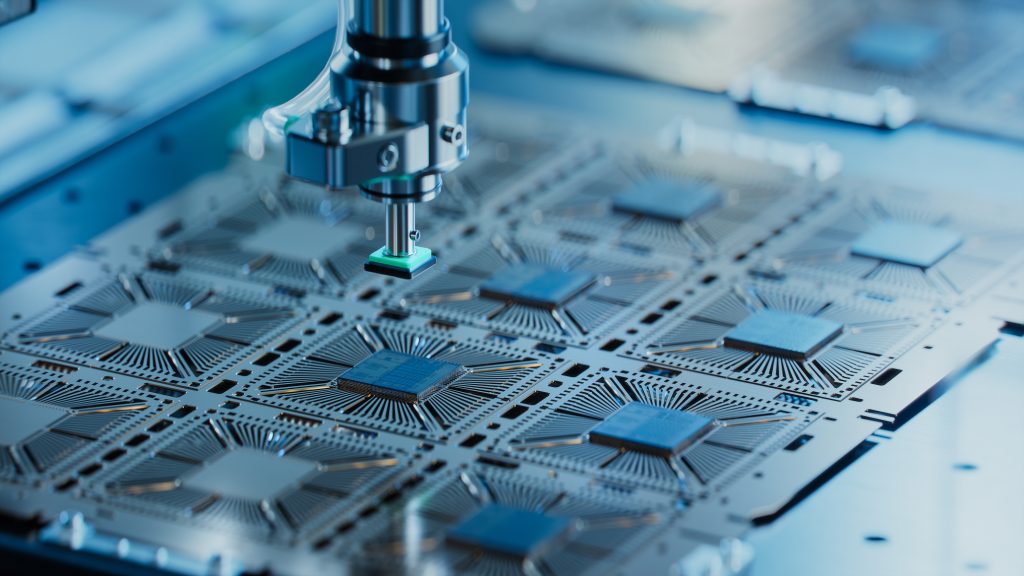

Arizona has become a critical hub for semiconductor manufacturing, home to more than 75 companies, including tier-one manufacturers like Intel and TSMC. The state’s semiconductor sector has seen 40 expansions since 2020, reflecting upwards of $65 billion in capital expenditures. However, the Section 232 investigation highlights vulnerabilities in the supply chain, particularly concerning reliance on APAC suppliers.

Two powerful, but often conflicting, influences are reshaping the semiconductor supply chain in real-time. On one side, a wave of pre-tariff buying sparked by months of geopolitical turmoil is inflating short-term demand. Experts worry about end-of-year uncertainty. Meanwhile, artificial intelligence is reshaping long-held market fundamentals and disrupting sourcing strategies across the board.

These forces are combining to create a uniquely volatile landscape that requires careful planning and an agile strategy to navigate safely. Procurement leaders must have a clear view of the drivers behind disruption and where the real opportunities lurk beneath the noise to steer their organizations in the right direction. The recent surge in global semiconductor sales, reaching $55.9 billion in March 2025, reflects this pre-tariff purchasing frenzy, though analysts caution against viewing this as a stable trend.

Scaling up U.S. semiconductor manufacturing presents several challenges, including high production costs and a shortage of skilled labor. Arizona’s initiatives, such as partnerships with local universities and community colleges, aim to address these hurdles by developing a robust talent pipeline. The state’s business-friendly environment, characterized by tax incentives and streamlined regulatory processes, further supports domestic production efforts. However, the need for substantial capital investment and technological advancements remains a barrier to rapid expansion. The CHIPS Act is providing significant funding to the industry in Arizona, with Intel’s Arizona fab expected to create about 9,000 jobs using part of its $7.87 billion CHIPS Act award. The state’s focus on sustainability and innovation could play a crucial role in maintaining competitive pricing and attracting further investment. As the industry grapples with these challenges, the role of AI in optimizing production processes becomes increasingly vital, offering a pathway to efficiency and cost reduction.

The potential for increased tariffs and trade restrictions could lead to higher prices for consumer electronics and industrial equipment. Arizona’s semiconductor industry, while poised for growth, must navigate these cost pressures. Companies are exploring strategies to absorb or offset these costs, such as investing in energy-efficient technologies and optimizing production processes. The state’s efforts to attract a diverse range of suppliers and manufacturers have created a comprehensive ecosystem that supports semiconductor production. By fostering collaboration between industry players and government entities, Arizona aims to enhance its supply chain’s adaptability and responsiveness to global market changes. The looming threat of tariffs has prompted many companies to accelerate their purchasing schedules, mirroring patterns seen in previous tariff cycles.

Mastering Inventory Management

Effective inventory management is critical in balancing lean practices with long lead-time risks and component shortages. Arizona’s semiconductor industry is leveraging AI-driven demand planning platforms, predictive analytics and digital twins to simulate supply scenarios and optimize safety stock levels. The shift toward digitizing the supply chain will revolutionize how companies manage their sourcing strategies. Organizations can adapt more effectively to the ever-changing global landscape by leveraging technology to streamline processes and enhance decision-making. As the industry continues to evolve, maintaining a flexible and responsive inventory management system will be key to sustaining growth and competitiveness. The COVID-19 semiconductors shortage has reinforced the necessity of agile inventory systems with high visibility and dynamic rebalancing capabilities.

Arizona’s semiconductor supply chain is at a pivotal moment, with the potential to reshape the industry’s future. As the state navigates these changes, its strategic initiatives and investments position it as a leader in semiconductor manufacturing. The outlook remains promising, with Arizona poised to play a crucial role in the global semiconductor landscape. As global trade policies continue to evolve, Arizona’s proactive approach to supply chain management will be essential in maintaining its competitive edge.

Samantha Hay is a sales and marketing analyst at DSV Inventory Management Solutions. She is a versatile communications and marketing professional with a strong foundation in problem solving, digital media and strategic thinking. Hay currently sits on the board of directors for the Institute for Supply Management’s Arizona chapter. She is also heavily involved with the SEMI Foundation, a 501(c)(3) nonprofit that focuses on experiential STEM programs for high school students globally. She graduated from Arizona State University with degrees in communications and psychology and received a Certificate in Foundations of Supply Chain Management from the W. P. Carey School of Business.

Samantha Hay is a sales and marketing analyst at DSV Inventory Management Solutions. She is a versatile communications and marketing professional with a strong foundation in problem solving, digital media and strategic thinking. Hay currently sits on the board of directors for the Institute for Supply Management’s Arizona chapter. She is also heavily involved with the SEMI Foundation, a 501(c)(3) nonprofit that focuses on experiential STEM programs for high school students globally. She graduated from Arizona State University with degrees in communications and psychology and received a Certificate in Foundations of Supply Chain Management from the W. P. Carey School of Business.