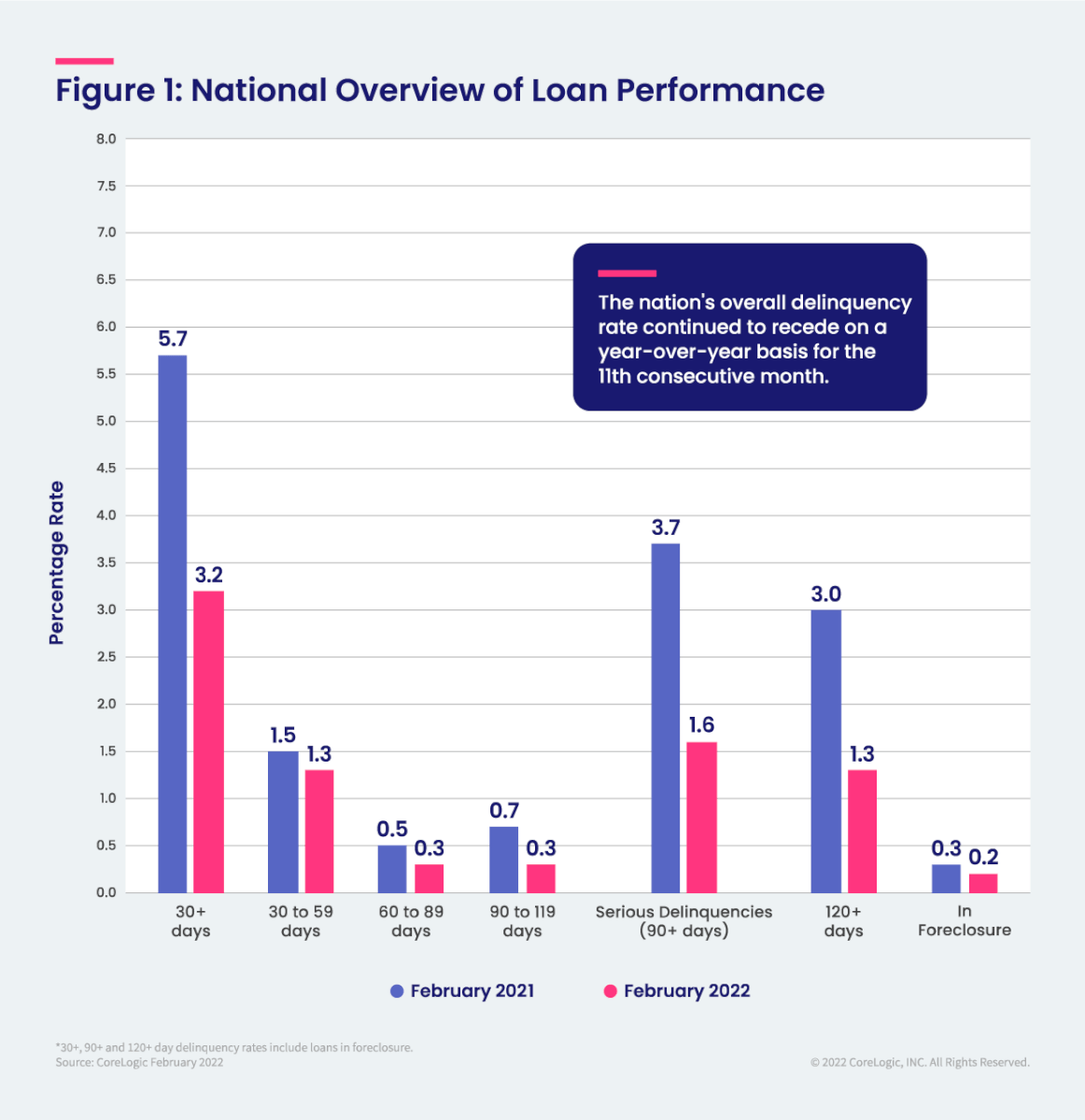

For the month of February, 3.2% of all mortgages in the U.S. were in some stage of delinquency (30 days or more past due, including those in foreclosure), representing a 2.5 percentage-point decrease compared to February 2021, when it was 5.7%.

To gain a complete view of the mortgage market and loan performance health, CoreLogic examines all stages of delinquency. In February 2022, the U.S. delinquency and transition rates, and their year-over-year changes, were as follows:

- Early-Stage Delinquencies (30 to 59 days past due): 1.3%, down from 1.5% in February 2021.

- Adverse Delinquency (60 to 89 days past due): 0.3%, down from 0.5% in February 2021.

- Serious Delinquency (90 days or more past due, including loans in foreclosure): 1.6%, down from 3.7% in February 2021 and a high of 4.3% in August 2020.

- Foreclosure Inventory Rate (the share of mortgages in some stage of the foreclosure process): 0.2%, down from 0.3% in February 2021. This remains the lowest foreclosure rate recorded since at least January 1999.

- Transition Rate (the share of mortgages that transitioned from current to 30 days past due): 0.8%, down from 0.9% in February 2021.

The U.S. overall delinquency rate fell to another historic low in February. This marked the 11th straight month of declines, with all states and metro areas recording annual drops in delinquencies. Home price growth continued to intensify as this year’s traditionally busy spring real estate season began, with prices rising by almost 21% since March 2021. However, national appreciation is expected to cool to around 6% by March 2023, which could cause equity gains to slow for homeowners in some areas of the country, providing less protection from mortgage defaults for those who fall behind on their payments.

“While job and income gains have helped push delinquency rates lower, some families continue to face financial stress,” said CoreLogic chief economist Dr. Frank Nothaft. “One-half of the borrowers who are seriously delinquent are behind on their payments by six or more months. Even though this group has been declining, the number that have missed at least six monthly payments is still double what it was in the months immediately prior to the pandemic.”

State and Metro Takeaways:

- In February, all states logged year-over-year declines in their overall delinquency rate. The states with the largest declines were Nevada (down 3.9 percentage points), Hawaii and Louisiana (both down 3.7 percentage points). The remaining states, including the District of Columbia, registered annual delinquency rate declines between 3.6 percentage points and 1.3 percentage points.

- All U.S. metro areas posted at least a small annual decrease in overall delinquency rates, with Odessa, Texas (7.2%); Laredo, Texas (6.7%) and Kahului-Wailuku-Lahaina, Hawaii (5.4%) showing the largest declines.

Methodology

The data in The CoreLogic LPI report represents foreclosure and delinquency activity reported through February 2022. The data in this report accounts for only first liens against a property and does not include secondary liens. The delinquency, transition and foreclosure rates are measured only against homes that have an outstanding mortgage. Homes without mortgage liens are not subject to foreclosure and are, therefore, excluded from the analysis. CoreLogic has approximately 75% coverage of U.S. foreclosure data.

No related posts.