The GDP estimate released today is based on source data that are incomplete or subject to further revision by the source agency (see “Source Data for the Advance Estimate” on page 3). The “second” estimate for the second quarter, based on more complete data, will be released on August 26, 2021.

The increase in real GDP in the second quarter reflected increases in personal consumption expenditures (PCE), nonresidential fixed investment, exports, and state and local government spending that were partly offset by decreases in private inventory investment, residential fixed investment, and federal government spending. Imports, which are a subtraction in the calculation of GDP, increased

The increase in PCE reflected increases in services (led by food services and accommodations) and goods (led by “other” nondurable goods, notably pharmaceutical products). The increase in nonresidential fixed investment reflected increases in equipment (led by transportation equipment) and intellectual property products (led by research and development). The increase in exports reflected an increase in goods (led by nonautomotive capital goods) and services (led by travel). The decrease in private inventory investment was led by a decrease in retail trade inventories.The decrease in federal government spending primarily reflected a decrease in nondefense spending on intermediate goods and services In the second quarter, nondefense services decreased as the processing and administration of Paycheck Protection Program (PPP) loan applications by banks on behalf of the federal government declined.

Current‑dollar GDP increased 13.0 percent at an annual rate, or $684.4 billion, in the second quarter to a level of $22.72 trillion. In the first quarter, current-dollar GDP increased 10.9 percent, or $560.6 billion (revised, tables 1 and 3). More information on the source data that underlie the estimates is available in the Key Source Data and Assumptions file on BEA’s website.

The price index for gross domestic purchases increased 5.7 percent in the second quarter, compared with an increase of 3.9 percent (revised) in the first quarter (table 4). The PCE price index increased 6.4 percent, compared with an increase of 3.8 percent (revised). Excluding food and energy prices, the PCE price index increased 6.1 percent, compared with an increase of 2.7 percent (revised).

Personal Income

Current-dollar personal income decreased $1.32 trillion in the second quarter, or 22.0 percent, in contrast to an increase of $2.33 trillion (revised), or 56.8 percent, in the first quarter. The decrease primarily reflected a decrease in government social benefits related to pandemic relief programs, notably the decrease in direct economic impact payments to households established by the Coronavirus Response and Relief Supplemental Appropriations Act and the American Rescue Plan Act (table 8). Additional information on factors impacting personal income can be found in Effects of Selected Federal Pandemic Response Programs on Personal Income.

Disposable personal income decreased $1.42 trillion, or 26.1 percent, in the second quarter, in contrast to an increase of $2.27 trillion, or 63.7 percent (revised), in the first quarter. Real disposable personal income decreased 30.6 percent, in contrast to an increase of 57.6 percent.

Personal outlays increased $680.8 billion, after increasing $538.8 billion. The increase in outlays was led by an increase in PCE for services.

Personal saving was $1.97 trillion in the second quarter, compared with $4.07 trillion (revised) in the first quarter. The personal saving rate—personal saving as a percentage of disposable personal income—was 10.9 percent in the second quarter, compared with 20.8 percent in the first quarter.

Source Data for the Advance Estimate

Information on the key source data and assumptions used in the advance estimate is provided in a Technical Note that is posted with the news release on BEA’s website. A detailed Key Source Data and Assumptions file is also posted for each release. For information on updates to GDP, see the “Additional Information” section that follows.

Annual Update of the National Economic Accounts

Today’s release also reflects the Annual Update of the National Income and Product Accounts; the updated Industry Economic Accounts will be released on September 30, 2021, along with the third estimate of GDP for the second quarter of 2021. The timespan of the update is the first quarter of 1999 through the first quarter of 2021 and resulted in revisions to GDP, GDI, and their major components. The reference year remains 2012. More information on the 2021 Annual Update is included in the May Survey of Current Business article, GDP and the Economy.

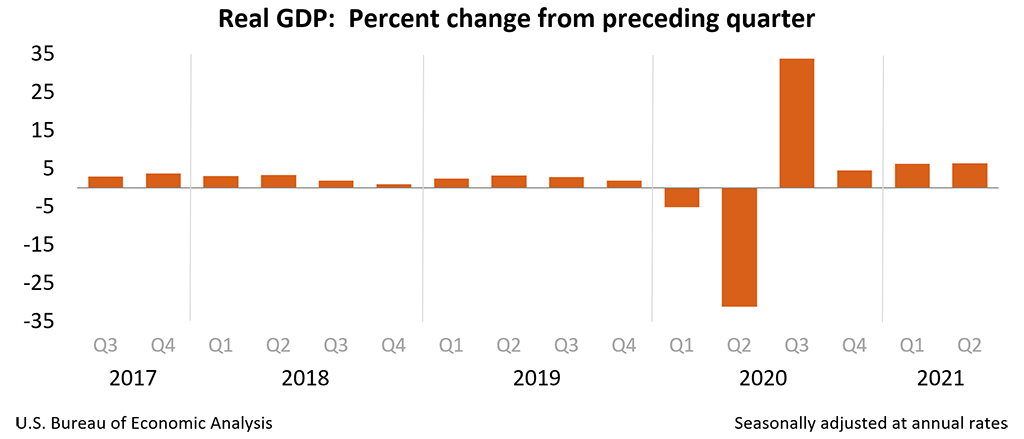

For the period of economic expansion from the second quarter of 2009 through the fourth quarter of 2019, real GDP increased at an annual rate of 2.3 percent, the same as previously published. For the period of economic contraction from the fourth quarter of 2019 through the second quarter of 2020, real GDP decreased at an annual rate of 19.2 percent, also the same as previously published. For the period of economic expansion from the second quarter of 2020 through the first quarter of 2021, real GDP increased at an annual rate of 14.1 percent, an upward revision of 0.1 percentage point from the previously published estimate.

With today’s release, most NIPA tables are available through BEA’s Interactive Data application on the BEA website. See Information on Updates to the National Economic Accounts for the complete table release schedule and a summary of results through 2020, which includes a discussion of methodology changes. A table showing the major current‑dollar revisions and their sources for each component of GDP, national income, and personal income is also provided. The August 2021 Survey of Current Business will contain an article describing the update in more detail.

Previously published estimates, which are superseded by today’s release, are found in BEA’s archives.

Updates for the First Quarter of 2021

For the first quarter of 2021, real GDP is estimated to have increased 6.3 percent (table 1), 0.1 percentage point less than previously published. The revision primarily reflected downward revisions to federal government spending, state and local government spending, and exports that were partly offset by an upward revision to nonresidential fixed investment.

Real GDI is now estimated to have increased 6.3 percent in the first quarter (table 1); in the previously published estimates, first-quarter GDI was estimated to have increased 7.6 percent. The leading contributor to the downward revision was compensation, based primarily on new first-quarter wage and salary estimates from the Bureau of Labor Statistics’ Quarterly Census of Employment and Wages.

The price index for gross domestic purchases is now estimated to have increased 3.9 percent in the first quarter, 0.1 percentage point lower than previously published (table 4). The PCE price index increased 3.8 percent, 0.1 percentage point higher than previously published. Excluding food and energy prices, the PCE price index increased 2.7 percent, 0.2 percentage point higher than previously published.

| First Quarter 2021 | ||

|---|---|---|

| Previous Estimate | Revised | |

| (Percent change from preceding quarter) | ||

| Real GDP | 6.4 | 6.3 |

| Current-dollar GDP | 11.0 | 10.9 |

| Real GDI | 7.6 | 6.3 |

| Average of Real GDP and Real GDI | 7.0 | 6.3 |

| Gross domestic purchases price index | 4.0 | 3.9 |

| PCE price index | 3.7 | 3.8 |

| PCE price index excluding food and energy | 2.5 | 2.7 |