CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for February 2024.

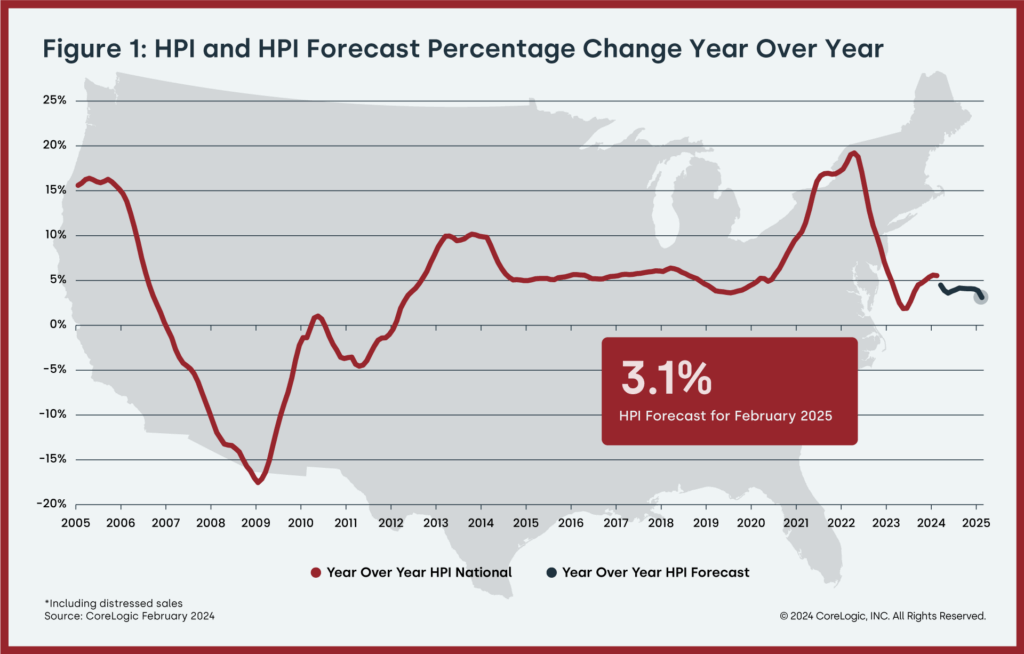

U.S. annual home price growth remained mostly consistent with numbers seen since last fall in February but finally slowed as the residual impact of comparing gains with weak 2022 home prices wore off. CoreLogic projects that year-over-year home price gains will continue to rise at a slower pace for the rest of 2024, which suggests more certainty for potential homebuyers who have been waiting to get a foot in the door. As noted in the most recent US CoreLogic S&P Case-Shiller Index report, an increase in for-sale inventory also benefits potential homebuyers, though affordability remains a concern, particularly if mortgage rates remain elevated throughout the spring homebuying season.

“Home price growth pivoted in February, as the impact of the January 2023 Home Price Index bottom finally faded,” said Dr. Selma Hepp, chief economist for CoreLogic. “As a result, the U.S. should begin to see slowing annual home price gains moving forward.”

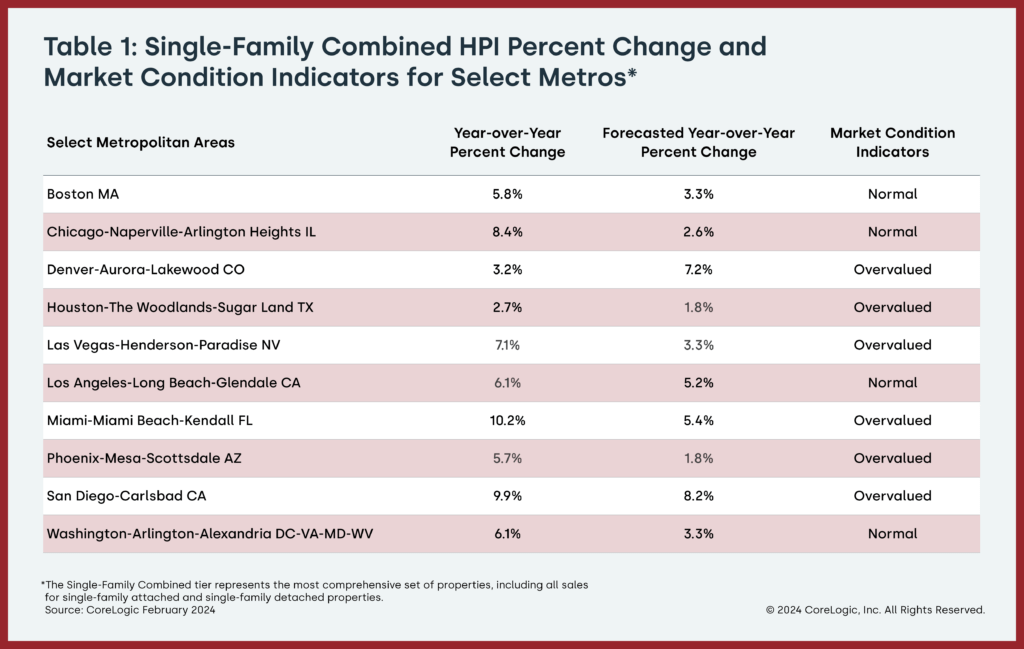

“Nevertheless,” Hepp continued, “with a 0.7% increase from January to February 2024, which is almost double the monthly increase recorded before the pandemic, spring home price gains are already off to a strong start despite continued mortgage rate volatility. That said, more inventory finally coming to market will likely translate to more options for buyers and fewer bidding wars, which typically keeps outsized price growth in check. Still, despite affordability challenges, homebuyer demand appears to favor already expensive, coastal markets with a limited availability of properties for sale.”

Top Takeaways:

- U.S. single-family home prices (including distressed sales) increased by 5.5% year over year in February 2024 compared with February 2023. On a month-over-month basis, home prices increased by 0.7% compared with January 2024.

- In February, the annual appreciation of detached properties (5.8%) was 1.2 percentage points higher than that of attached properties (4.6%).

- CoreLogic’s forecast shows annual U.S. home price gains relaxing to 3.1% in February 2025.

- Miami posted the highest year-over-year home price increase of the country’s 10 highlighted metro areas in January, at 10.2%. San Diego saw the next-highest gain at 9.9%.

- Among states, South Dakota ranked first for annual appreciation in January (up by 13.8%), followed by New Jersey (up by 12.5%) and Rhode Island (up by 11.6%). Only Idaho recorded a year-over-year home price loss of -0.1%.

No related posts.