CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for January 2023.

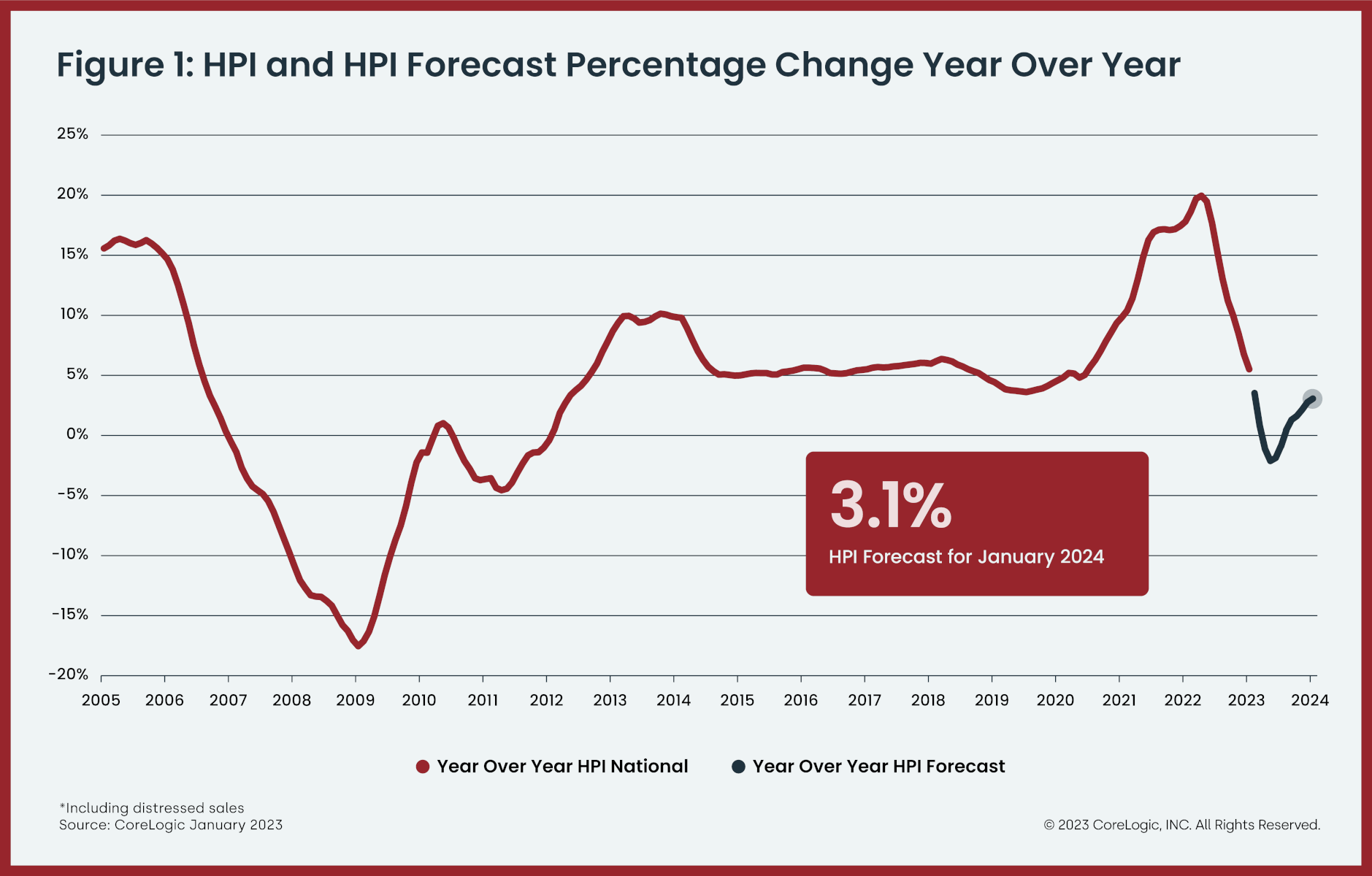

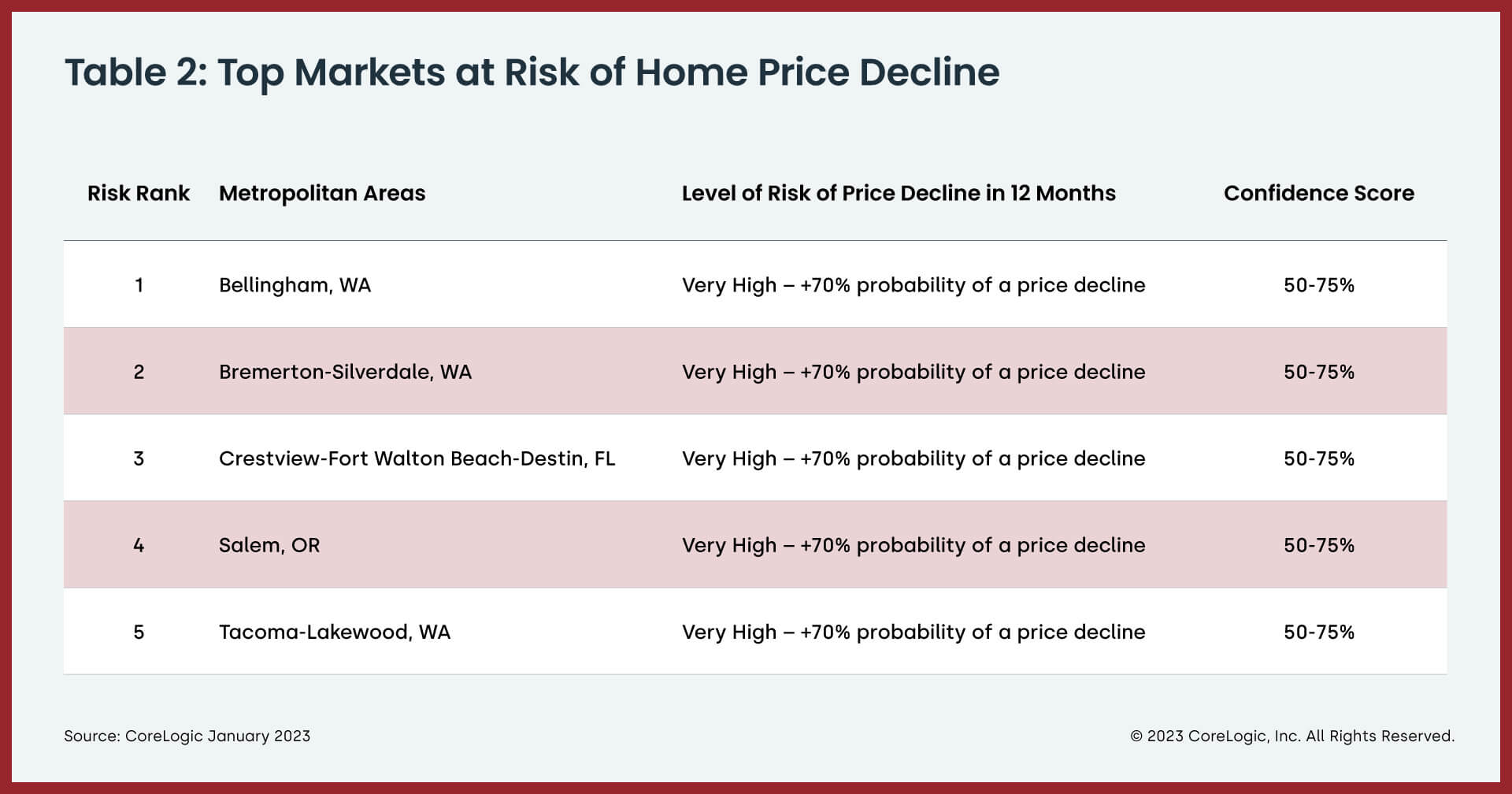

U.S. home prices continued their gradual free fall in January, with the 5.5% annual gain down for the ninth straight month and the lowest recorded since June 2020. Deceleration was particularly noticeable in the Western U.S. and other states and metro areas that saw substantial appreciation over the past few years. Three Northwestern states (along with Washington, D.C.) posted at least slight annual declines as migration patterns that began during the pandemic shifted, slowing demand and driving price decreases.

“While 2023 kicked off on a more optimistic note for the U.S. housing market, recent mortgage rate volatility highlights how much uncertainty remains,” said Selma Hepp, chief economist at CoreLogic. “Nevertheless, the continued shortage of for-sale homes is likely to keep price declines modest, which are projected to top out at 3% peak to trough.”

“Home price depreciation and strong income growth are expected to boost affordability, which is particularly important for first-time buyers,” Hepp continued. “This group has accounted for a higher share of mortgage applications since last summer, as first-time buyers don’t need to surrender an extremely low mortgage rate like current homeowners.”

Top Takeaways:

- U.S. home prices (including distressed sales) increased by 5.5% year over year in January 2023 compared to January 2022. On a month-over-month basis, home prices declined by 0.2% compared to December 2022.

- In January, the annual appreciation of attached properties (6.5%) was 1.3 percentage points higher than that of detached properties (5.2%).

- CoreLogic forecasts show annual U.S. home price gains slowing to 3.1% by January 2024.

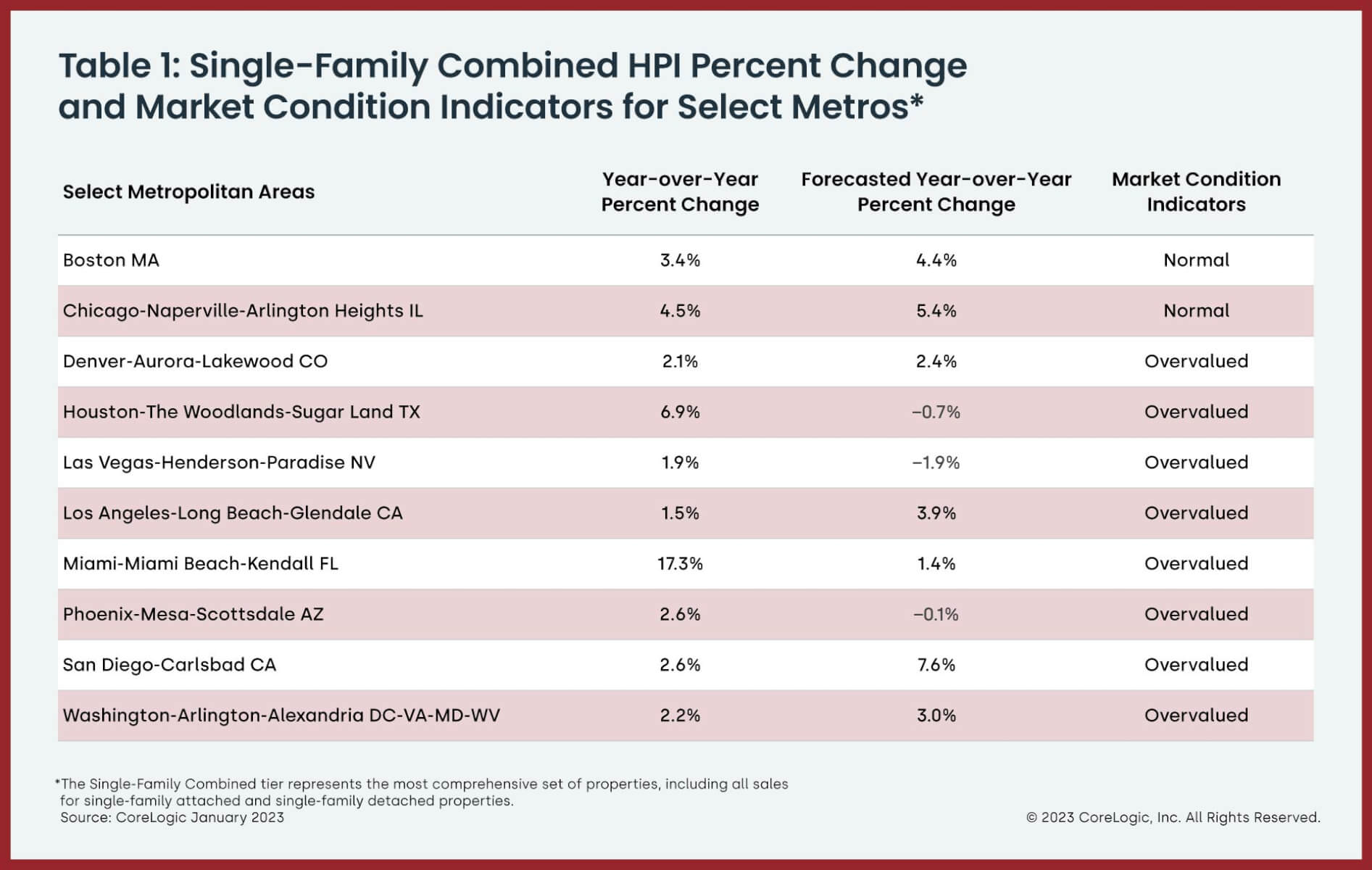

- Miami posted the highest year-over-year home price increase of the country’s 20 largest metro areas in January, at 17.3%, while Tampa, Florida continued to rank second at 11.7%.

- Florida and Maine recorded the highest annual home price gains, 13.4% and 11.5%, respectively. South Carolina posted the third-highest gain, with a 10.7% year-over-year increase. Three states and one district registered year-over-year price declines: Idaho (-2.3%), Washington (-2.2%), Montana (-0.6%) and Washington, D.C. (-0.1%).

The next CoreLogic HPI press release, featuring February 2023 data, will be issued on April 4, 2023, at 8 a.m. EST.

Methodology

The CoreLogic HPI™ is built on industry-leading public record, servicing and securities real-estate databases and incorporates more than 45 years of repeat-sales transactions for analyzing home price trends. Generally released on the first Tuesday of each month with an average five-week lag, the CoreLogic HPI is designed to provide an early indication of home price trends by market segment and for the Single-Family Combined tier, representing the most comprehensive set of properties, including all sales for single-family attached and single-family detached properties. The indices are fully revised with each release and employ techniques to signal turning points sooner. The CoreLogic HPI provides measures for multiple market segments, referred to as tiers, based on property type, price, time between sales, loan type (conforming vs. non-conforming) and distressed sales. Broad national coverage is available from the national level down to ZIP Code, including non-disclosure states.

No related posts.