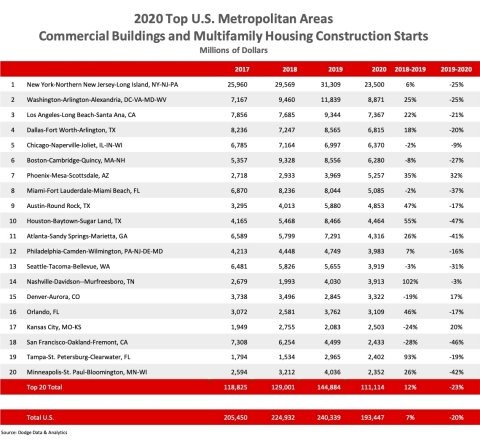

The value of commercial and multifamily construction starts in the top 20 metropolitan areas of the U.S. lost 23% in 2020, falling to $111.1 billion according to Dodge Data & Analytics. Nationally, commercial and multifamily starts tumbled 20% over the year to $193.4 billion. Commercial and multifamily construction starts in the top 10 metro areas dropped 23% during the year with only one metro area — Phoenix AZ — reporting an increase. In the second largest group of metro areas (those ranked 11 through 20), commercial and multifamily construction starts also lost 23%, with only Denver CO and Kansas City MO posting an increase for the year.

The New York metropolitan area continued to be the largest market for commercial and multifamily starts at $23.5 billion but suffered a stark 25% decline from 2019. The Washington DC metro area managed to maintain its second place standing despite an identical decline in 2020 lowering commercial and multifamily starts to $8.9 billion. The Los Angeles CA metro area, which fell 21% to $7.4 billion, ranked third. The remaining top 10 metropolitan areas in 2020 were Dallas TX down 20% ($6.8 billion), Chicago IL down 9% ($6.4 billion), Boston MA 27% lower ($6.3 billion), Phoenix up 32% ($5.3 billion), Miami down 37% ($5.1 billion), Austin down 17% ($4.9 billion) and Houston down 47% ($4.5 billion). In sum, the top 10 metropolitan areas accounted for 41% of all U.S. commercial and multifamily construction starts in 2020, down from a 43% share in 2019.

The second largest metro group included: Atlanta GA down 41% ($4.3 billion), Philadelphia PA down 16% ($4.0 billion), Seattle WA down 31% ($3.9 billion), Nashville TN down 3% ($3.9 billion), Denver CO up 17% ($3.3 billion), Orlando FL down 17% ($3.1 billion), Kansas City MO up 20% ($2.5 billion), San Francisco CA down 46% ($2.4 billion), Tampa FL down 19% ($2.4 billion), and Minneapolis MN down 42% ($2.4 billion). This group of metro areas accounted for 17% of total U.S. commercial and multifamily activity in 2020, the same share as in the previous year.

The commercial and multifamily total is comprised of office buildings, stores, hotels, warehouses, commercial garages, and multifamily housing. Not included in this ranking are institutional building projects (e.g., educational facilities, hospitals, convention centers, casinos, transportation terminals), manufacturing buildings, single family housing, public works, and electric utilities/gas plants. Total U.S. commercial and multifamily building starts dropped 20% in 2020 to $193.4 billion from the $240.3 billion in 2019. Commercial building starts lost 26% to $104.0 billion, while multifamily building activity slid 11% lower to $89.5 billion. Within the top 10 metro areas, commercial building starts dropped 26%, while multifamily building activity fell 21%. Within the second largest group of metropolitan areas, commercial building starts fell 30% in 2020, while multifamily building starts lost 15%.

“The pandemic is having a significant negative impact on commercial and multifamily construction across the country,” stated Richard Branch, Chief Economist for Dodge Data & Analytics. “While some areas stabilized over the summer, the current wave of the virus has further hindered activity. The recently passed $900 billion stimulus plan will go a long way towards re-energizing the economy.” Branch continued, “The construction sector will show signs of recovery in 2021, but, the road back to full recovery will be long and difficult. The effects of the pandemic on the U.S. economy and building markets will be felt for several years.”

In the New York NY metropolitan area, commercial and multifamily construction starts dropped 25% in 2020 to $23.5 billion, after increasing 6% in 2019. Multifamily construction starts in the metro area had been very robust over the past several years but posted a significant 27% decline in 2020. The largest multifamily building to break ground was the $500 million Bankside mixed-use project in the Bronx NY. Also starting in 2020 were the $500 million Pacific Park mixed-use building in Brooklyn NY and the $420 million Hunter’s Point South complex in Long Island City NY. Commercial building starts, meanwhile, fell 22% in 2020 — a decline that would have been much more significant if not for the metro area’s increase in office starts. All other commercial construction sectors fell over the year. The largest commercial buildings to break ground in 2020 were the $1.3 billion Two Manhattan West office building, the $1.3 billion One Madison Avenue office project and the $760 million Disney/ABC Headquarters building.

Commercial and multifamily building starts in Washington DC fell 25% in 2020 to $8.9 billion following a 25% gain in 2019. Multifamily building starts in the metro area gained 2% during the year. The largest multifamily project to get underway was the $200 million 300 M NE Street mixed-use project. Also breaking ground were the $160 million first phase of the Sursum Corda Cooperative Apartments and the $150 million first phase of the Sursum Corda Cooperative apartments. Commercial construction starts fell 42% in Washington DC during 2020, with all commercial sectors posting significant declines for the year. The largest commercial project to start during the year was the $306 million Aligned Energy data center in Ashburn VA. Also moving forward to groundbreaking in 2020 were Towers 1 & 2 of the Amazon HQ2 complex each valued at $240 million.

Los Angeles CA’s commercial and multifamily building starts tumbled 21% in 2020 to $7.4 billion following a 22% gain the previous year. Commercial building starts in 2020 fell by 35%, although office construction starts in the metro posted a gain. All other commercial building types fell over the year. The largest commercial building to start during the year was the $355 million Fig + Pico AC Marriott/Hilton hotel. Also starting was the $330 million second phase of the Iceberg Towers and the $300 million Lumen West office project. Multifamily building starts lost 2% in Los Angeles during 2020. The largest multifamily buildings to get underway were the $275 million Figueroa Center mixed-use project, $200 million 8th and Figueroa mixed-use project, and the $167 million AVA Arts District Live/Work Complex.

Commercial and multifamily construction starts in Dallas TX fell 20% in 2020 to $6.8 billion after an 18% gain in starts the prior year. Multifamily housing starts in the metro area dropped 15% during 2020. The largest multifamily building project to get underway was the $75 million Novel Turtle Creek residential tower. Also starting were the $65 million Shannon Creek Apartments in Burleson TX and the $64 million Stevenson Oaks Senior Living Complex in Fort Worth. Commercial building starts lost 23% for the year. The decline was the result of sizeable pullbacks in office, hotel, and parking structures. Retail construction starts were flat over the year, while warehouse starts posted a sizeable gain. The largest commercial building to start in 2020 was the $135 million Epic Deep Ellum office building. Also starting was the $100 million American Airlines Flight Kitchen, a retail building, in addition to an $80 million warehouse project in Forney TX.

Chicago IL commercial and multifamily construction starts dropped 9% in 2020 to $6.4 billion, following a 2% decline the previous year. Commercial building starts in 2020 increased 40% due to gains in office and warehouse starts. The largest commercial buildings to break ground in 2020 were the $800 million Facebook data center in Dekalb Township, the $476 million BMO office tower, and the $360 million Wolf Point South Tower B office building. Chicago’s multifamily building starts, by contrast, fell 54% in 2020. The largest multifamily building to break ground in 2020 was the $252 million mixed-use project at 300 N. Michigan Ave. Also starting during the year were the $150 million 354 N Union apartment tower and the $100 million Maple Street Lofts.

In Boston MA, commercial and multifamily building starts lost 27% during 2020 to $6.3 billion after falling 8% in 2019. Multifamily building starts dropped 21% in 2020. The largest multifamily building to start in the Boston metro area during 2020 was the $154 million 55 Wheeler Street building in Cambridge. Also starting were the $150 million Cambridge Crossing development in Cambridge MA and the $120 million Hanover Wellesley project in Wellesley. Commercial building starts fell 30% in the metro area during 2020. All types of commercial structures lost ground during the year except for warehouses. The largest commercial structure to get underway in 2020 was the $700 million Citizen M hotel and office building in Boston. Also starting during the year were the $450 million first phase of the South Station Office Tower and the $250 million Seaport Square office project.

Commercial and multifamily building starts in Phoenix AZ gained 32% in 2020 to $5.3 billion following a 35% gain the prior year. Phoenix was the only metro area ranked in the top 10 to post a year-over-year increase in construction starts. Commercial building starts increased 20% in 2020 due to gains in warehouses, hotels, and parking structures, while office and retails starts contracted. The largest commercial project to break ground in 2020 was the $200 million 100 Mill Ave project in Tempe. Also starting were the $143 million Gila River Wild Horse Pass hotel in Chandler and the $115 million Park 303 warehouse project in Glendale. Multifamily building starts increased 52% in Phoenix during 2020. The largest multifamily projects to get underway during the year were the $300 million Pier 202 mixed-use project in Tempe, the $125 million Adeline Residences, and the $100 million Scottsdale Entrada mixed-use project in Scottsdale.

Miami FL commercial and multifamily construction starts fell 37% in 2020 to $5.1 billion, following a 2% decline in 2019. Multifamily building starts lost 31% last year. The largest multifamily building projects in Miami to break ground last year were the $249 million Downtown 5th Luxury Apartments, the $115 million Miami Urban Village Apartments in Homestead, and the $100 million SLS Resort Residences in Hallandale Beach. Commercial construction dropped 43% over the year, with only warehouses able to post a gain. The largest commercial building to break ground was the $100 million Pier Sixty-Six Hotel in Fort Lauderdale. Also starting were an $85 million Amazon warehouse in Jupiter and a $78 million Amazon warehouse in Homestead.

In 2020 Austin TX commercial and multifamily starts slid 17% to $4.9 billion after gaining 47% in 2019. Commercial building starts lost 31% in 2020 due to large declines in offices, hotels, retail, and parking structures. Warehouse starts, however, posted a sizeable gain. The largest commercial buildings to break ground in 2020 were the $500 million Apple Corporate Campus #2, the $326 million Texas Department of Transportation office campus, and the $300 million Amazon distribution facility in Pflugerville. Multifamily building starts rose 4% in 2020, with the largest projects including the $150 million 44 East Condo Tower, the $120 million Hanover Republic Square Apartments, and the $100 million Greystar Menchaca Road Apartments.

Houston TX commercial and multifamily construction starts dropped 47% during 2020 to $4.5 billion on the heels of a 55% gain in 2019. Commercial building starts lost 47% in 2020, with all major commercial building types posting sizeable year-over-year declines. The largest commercial projects to start during the year were the $100 million Hewlett Packard Enterprises Campus at Cityplace, the $85 million Hyatt Place/Hyatt House Hotel, and an $85 million Amazon distribution center in Richmond. Multifamily building starts fell 48% in 2020. The largest multifamily projects to break ground were the $217 million Hanover Square & Bayou Apartments, the $200 million High Street Residential Apartments, and the $70 million Boone Manor Apartments.

Dodge Data & Analytics is North America’s leading provider of commercial construction project data, market forecasting & analytics services and workflow integration solutions for the construction industry. Building product manufacturers, architects, engineers, contractors, and service providers leverage Dodge to identify and pursue unseen growth opportunities that help them grow their business. On a local, regional or national level, Dodge empowers its customers to better understand their markets, uncover key relationships, size growth opportunities, and pursue specific sales opportunities with success. The company’s construction project information is the most comprehensive and verified in the industry. Dodge is leveraging its more than 125-year-old legacy of continuous innovation to help the industry meet the building challenges of the future.