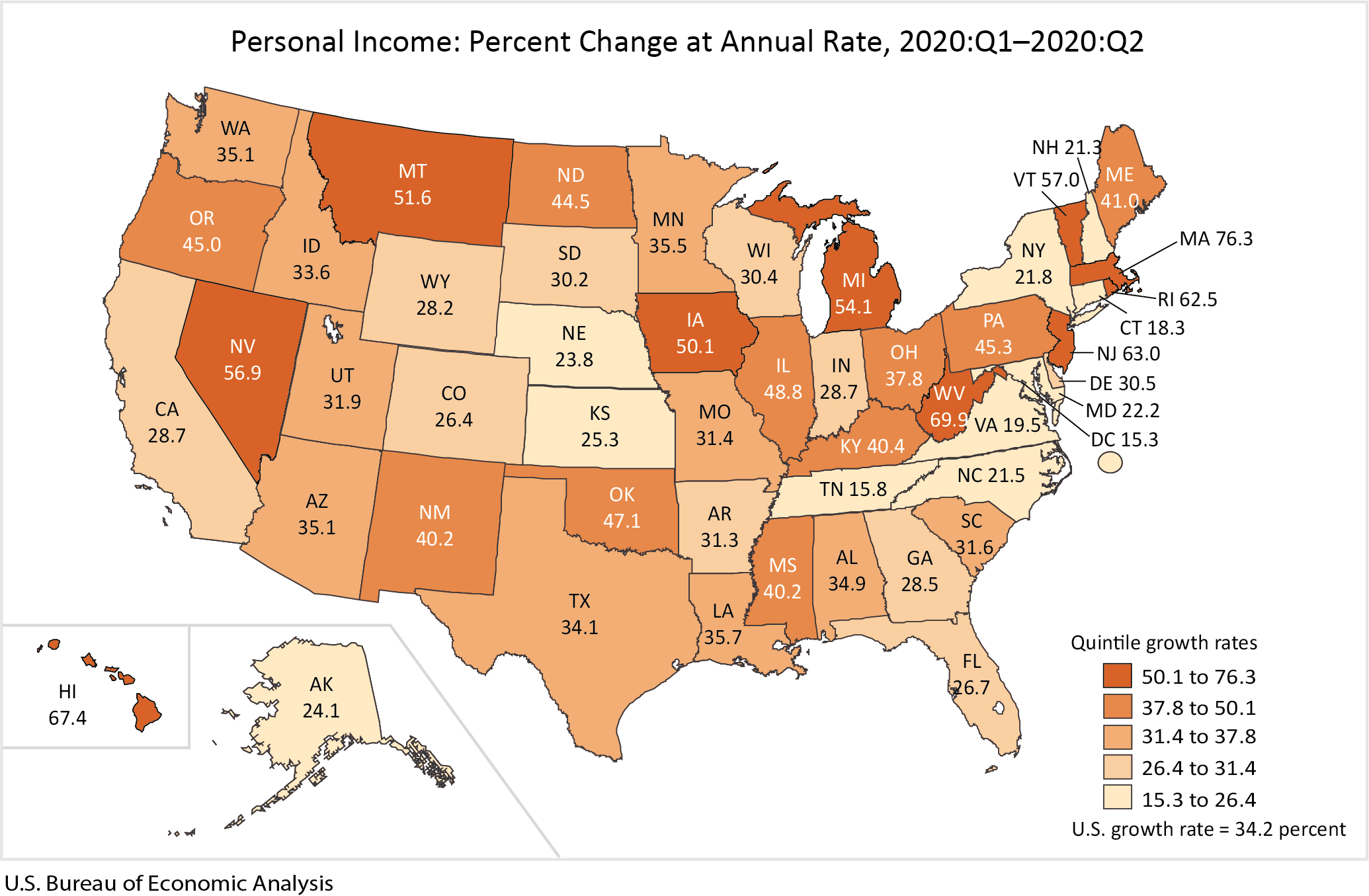

State personal income increased 34.2 percent at an annual rate in the second quarter of 2020, an acceleration from the 4.1 percent increases in the first quarter, according to estimates released today by the Bureau of Economic Analysis (table 1). Personal income increased in every state and the District of Columbia ranging from 15.3 percent in the District of Columbia to 76.3 percent in Massachusetts.

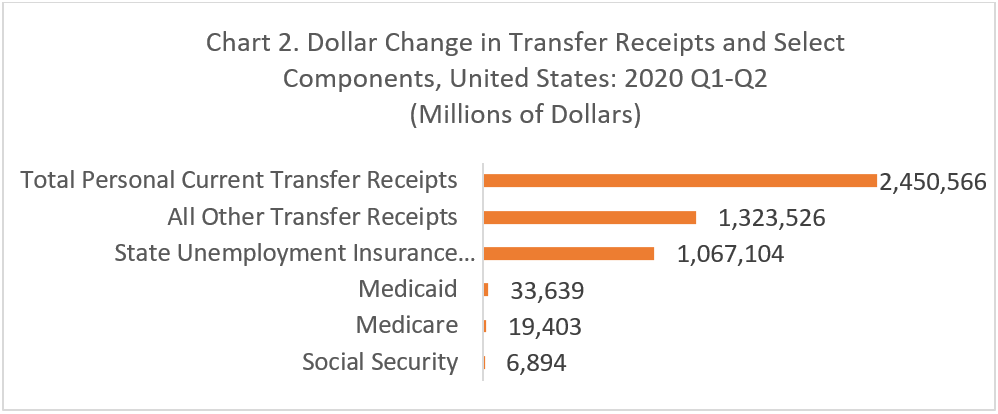

Increases in personal current transfer receipts more than offset decreases in earnings and in property income (chart 1). The increase in transfer receipts includes new government relief payments provided by the Coronavirus Aid, Relief, and Economic Security (CARES) Act of 2020.

Increases in personal current transfer receipts more than offset decreases in earnings and in property income (chart 1). The increase in transfer receipts includes new government relief payments provided by the Coronavirus Aid, Relief, and Economic Security (CARES) Act of 2020.

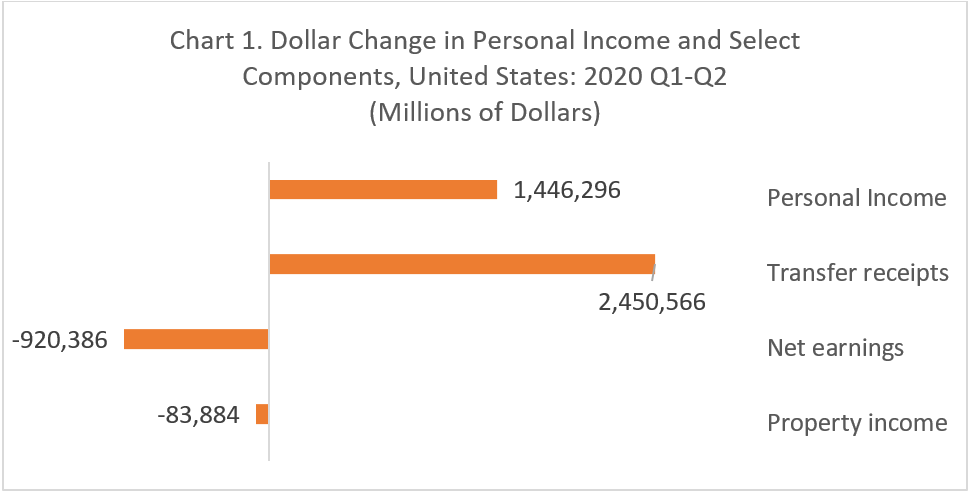

Transfer receipts. Transfer receipts increased $2.5 trillion for the nation in the second quarter of 2020, after increasing $80.3 billion in the first quarter. The increase in transfer receipts reflected increases in state unemployment insurance compensation, all other transfer receipts and Medicaid benefits (chart 2). Transfer receipts increased in every state, ranging from $3.8 billion in Wyoming to $342.6 billion in California (table 2).

Transfer receipts. Transfer receipts increased $2.5 trillion for the nation in the second quarter of 2020, after increasing $80.3 billion in the first quarter. The increase in transfer receipts reflected increases in state unemployment insurance compensation, all other transfer receipts and Medicaid benefits (chart 2). Transfer receipts increased in every state, ranging from $3.8 billion in Wyoming to $342.6 billion in California (table 2).

State unemployment compensation was boosted by a $600 increase in weekly benefits provided by the CARES Act, as well as an expansion of eligibility of workers not previously covered by state unemployment compensation programs. The increase in all other transfers reflected $1,200 economic impact payments to individuals, as well as provider relief funds for nonprofit institutions, such as hospitals and health care providers, serving individuals.

The 2020 Q2 estimates of state personal income were impacted by the response to the spread of COVID-19, as governments issued and lifted “stay-at-home” orders, and government pandemic assistance payments were distributed to households and businesses. The full economic effects of the COVID-19 pandemic cannot be quantified in the state personal income estimates because the impacts are generally embedded in source data and cannot be separately identified. For more information, see the Technical Note.

Tables showing the Effects of Selected Federal Pandemic Response Programs on State Personal Income for every state and the District of Columbia will be made available on October 15, 2020.

Earnings. For the nation, earnings decreased 27.5 percent in the second quarter of 2020, after increasing 3.4 percent in the first quarter (table 2). The declines were moderated by Paycheck Protection Program (PPP) loans to proprietors. The decrease in earnings reflected the partial economic shutdown following the outbreak of the COVID-19 pandemic in the first quarter of 2020.

Earnings decreased in 20 of the 24 industries for which BEA prepares quarterly estimates (table 4). Accommodations and food services, and healthcare and social assistance were the leading contributors to the overall earnings decrease. The percent change in earnings across all states ranged from -14.0 percent in Utah to -38.1 percent in Nevada.

Property income. Property income decreased 8.6 percent for the nation in the second quarter of 2020, after increasing 1.1 percent in the first quarter. Property income decreased in every state, ranging from -4.8 percent in West Virginia to -12.1 percent in Utah.